“The modest recovery is showing encouraging signs. The demand side is getting stronger, not weaker. We have to treat the recovery with extreme caution. It is very fragile. It is starting from very low levels but it is proceeding.”

“The modest recovery is showing encouraging signs. The demand side is getting stronger, not weaker. We have to treat the recovery with extreme caution. It is very fragile. It is starting from very low levels but it is proceeding.”

So said Mario Draghi, the ECB’s boss, two days ago. The recovery has thus become a modestly recovering not entirely weak but cautiously fragile low-level proceeding recovery of an encouraging nature. In offering up this pessimistically optimistic (and thus delicately balanced) view, the Italian banker was treading in the Yeti-like footprints of the German Kalsruhe Court from the day before.

The men in red with funny hats had observed that Open Market stuff from the ECB was sort of UnGerman, and very probably unconstitutional within the Bundesrepublik’s laws, but therefore not really a matter for them given that we are all Europeans now which probably makes us irrelevant or something and I was only obeying orders.

All in all, they pronounced, the ECB’s open market fraudy-printy-silly thing was legally dead, but in practical terms, perhaps necessary and thus (so long as it spent a lot of time resting between engagements) very probably not dead at all really.

It feels to me at the moment that pretty much everything is being stated in this manner, which I have started to dub negative positivism. For example, although a man of bombast at the Commons dispatch box, George Osborne nevertheless continues to come out with stuff like “…there is still a long way to go before a full recovery…we’ve got to make more cuts…there are big, underlying issues….There’s still a long way to go. We’re borrowing around £100 billion a year – and paying half that money a year in interest just to service our debts..We’ve got to make more cuts. That’s why 2014 is the year of hard truths – the year when Britain faces a choice…”.

So even though we’re deeper yet in the sh*t, the tide is turning and our strategy is on course to allow Britain to face a choice. The thing I’m struggling with here is exactly what that choice might be.

Let’s go to our correspondent across the Atlantic now, and hear what Prezzdayunt Black Dude had to say last week: “The American recovery is under way,” he opined superficially, “but it is largely benefitting those at the top, it’s a low-wage recovery”. So it’s an American topspin recovery involving falling wages, but at least that’s one up from a jobless recovery, right? Great – we have progress.

“Here are the results of your efforts,” said the Dude, “The lowest unemployment rate in over five years, a rebounding housing market; a manufacturing sector that’s adding jobs for the first time since the 1990s, but – and there’s always a but these days – average wages have barely budged, inequality has deepened; upward mobility has stalled, and oh f**k, I just remembered…I’m the President”.

Let’s examine that ‘rebounding housing market’. This from that den of Communist iniquity the Wall Street Journal last Friday: ‘Just over 4,500 California homes were sold for between $2 million and $3 million last year, according to DataQuick…..The rest of the market is still a ways from being back. The number of $1 million to $2 million properties was still about 25% lower than its prebubble level, while home sales that are less than $1 million — the vast majority of homes — was a little more than half of their highs hit before the recession.’

So it’s a sort of low wage, high property value bubble, deepening inequality, downward mobility recovery after all. Yessir, a perfectly normal mixture of Obama saying one thing, and doing (or meaning) another. It’s all about Checks and Balances: it’s the American Way. Ben Bernanke grasped this around 2007, and it has seen him through the worst and longest econo-fiscal crisis in US history with barely a fleck of fan-merde hitting his body.

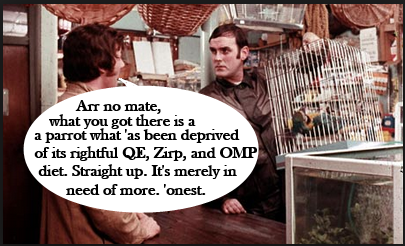

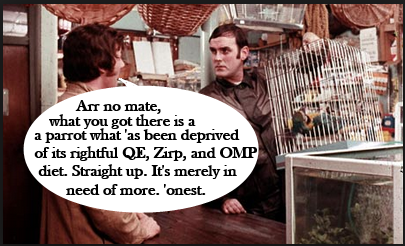

Let’s face it folks, our leaders are mealy of mouth, small of brain, big on rhetoric – and homoaeopathic on the detail of whether things are getting slowly better, or rapidly much less worse, or perhaps even more reassuringly staying exactly where they are. The only thing they are in total concert about is that the parrot is not dead.

I wonder if Michael Palin is watching all this denial of extinction with a wry smile. I’d imagine he is, because he is one of the world’s great bollocks deconstructors. If you’ve never seen him and his parrot client John Cleese

tearing into the Life of Brian detractors, then I recommend highly that you do so.

I realise I am but a sample of one, but little would please me more all these years later than to have Michael Palin doing all the Draghi-Osborne-Obama-Bernanke press conferences, and John Cleese playing a hack in a pakamac saying, “‘E’s not pinin’! ‘E’s passed on! This parrot is no more! He has ceased to be! ‘E’s expired and gone to meet ‘is maker! ‘E’s a stiff! Bereft of life, ‘e rests in peace! If you hadn’t nailed ‘im to the perch ‘e’d be pushing up the daisies! ‘Is metabolic processes are now ‘istory! ‘E’s off the twig! ‘E’s kicked the bucket, ‘e’s shuffled off ‘is mortal coil, run down the curtain and joined the bleedin’ choir invisible!! THIS IS AN EX-PARROT!!’

Last night at The Slog: Tears for souvenirs in France

“The modest recovery is showing encouraging signs. The demand side is getting stronger, not weaker. We have to treat the recovery with extreme caution. It is very fragile. It is starting from very low levels but it is proceeding.”

“The modest recovery is showing encouraging signs. The demand side is getting stronger, not weaker. We have to treat the recovery with extreme caution. It is very fragile. It is starting from very low levels but it is proceeding.”