UPDATED @ 15.30 pm CET:

Frances Coppola has asked me to point out, since this post first appeared, that I typed ‘Fortune’ instead of ‘Forbes’ twice. I have changed this, although would point out that a very clear link had been given to her piece at the start of my essay. She has also asked me to remove the words ‘blame the women’ in the concluding paragraph. This I have also done, but while pointing out her own words about ‘older people’.

Ms Coppola has stated on Twitter that I ‘must’ revise the piece. I will not do this beyond the revisions mentioned above.

In the 35 minutes since my post went up, she has sent me 15 notifications, accusations and demands. Only two of them make any sense to me; the others include:

- That I imply her article is about WASPI. Her contention here is that because MY article uses WASPI in the headline, HERS must ergo be about WASPI. I struggle with that one given the previous paragraph specifically says ‘Twitter’, but readers must decide for themselves

- That my piece is full of factual errors. It is not, but again I leave the decision on that to you.

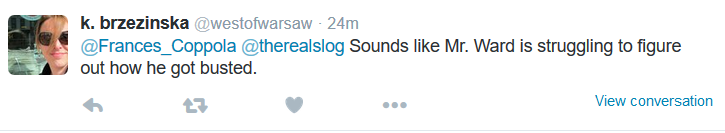

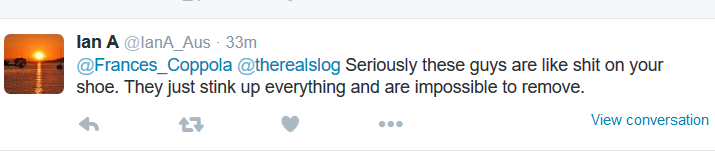

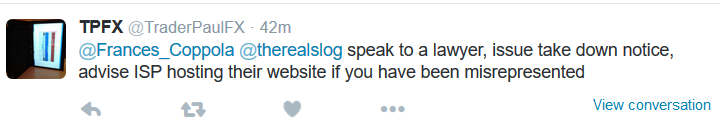

I have also received these tweets supportive of Ms Coppola’s position:

I’m afraid I don’t find ‘busted’, ‘shit on your shoes’ ‘issue take down notice’ as especially redolent of free speech. I do not propose to make any further revisions to the content below. The only thing revised in my mind is the previously very high opinion I had of Frances Coppola.

_________________________

A few of you on Twitter may have noticed, over the last few days, a spirited and at times angry debate going on about State pensions. Only a few of you followed it because (a) most of the contention concerns the UK’s approach to it and (b) most of you aren’t women aged from roughly 57-61. It is a truism of contemporary government in the West that not all minorities are equal….and the ability to govern successfully consists of not angering too many vocal people at any one time. But this doesn’t make the anger of those affected by the dashing of perfectly understandable expectations go away.

My italicising of ‘perfectly understandable expectations’ there is what separates the protagonists in the debate. The shades of opinion that are immediately involved I would describe as Frances Coppola, ideological apologists, the UK pro-women lobbying group WASPI, and one or two other folks, one of whom is me. As such, they are not homogenous as thinkers, nor do they approach the issue from the same starting blocks. Twas ever thus.

Frances has just published a well-researched essay at Forbes explaining, in her view, how and why the problem has arisen, and concluding that

‘it would help if older people stopped making demands for restoration of the entitlements of the past. Those days are gone, and the future will be very different.’

The specific purpose of my post today is to contest three assertions: first, that the problem can only be solved by a retreat by government from the benefits offered; second, that the ‘losers’ referred to in her Forbes piece – not the word I would’ve chosen – had plenty of notice about retreats; and third, that future benefits must come largely or solely from private/Bourse owned corporate entities.

Overall, however, I think the State pension dilemma is part of a broader argument about the role of government within what I regard as the seriously flawed economic model in vogue today. I will therefore also try to point out where and how radical econo-political reform can question the TINA syndrome – There Is No Alternative – if the policy priorities are justifiably challenged.

°°°°°°°°°°°°°°°°°°°°°°

The potted history of State old-age insurance provision offered by Ms Coppola deserves everyone’s attention (not least that of the politician) because it sets out dispassionately and largely without ideological syntax what happened, when, and how it was a quasi-actuarial package based on assumptions about participation levels.

My departure from that narrative begins with what I see as a zero-blame analysis casually applied to the creation of the postwar Welfare State. I have felt for nigh on thirty years that the 1946 Act was based on simplistic assumption, incompetent projection, and typically mendacious political presentation. I know that hindsight is a wonderful thing, but from the outset it was clear to many in Whitehall – and in a still socially reforming Tory Party with new intake – that Labour had pledged to do the impossible.

The first assumption – that it would remain something only used by relatively small numbers of people – ran against the massive developments in pharmaceuticals accelerated by the catalyst of war injuries….notably antibiotics, the study of skin damage, the causes of dehydration, brain surgery, and immunisation against disease. The second – that population trends would remain unchanged – was not only counter-intuitive, it flew in the face of evidence the Health Ministry already had about the meteoric rise in VD and illegitimate births.

Conversely, thinkers like R A Butler had already pointed to the mismatch between wartime marriage rates (growing) and marital fertility (falling): it is after all quite hard to impregnate one’s wife from the Rhine, Monte Cassino or Burma. The relaxation of sexual mores and the returning sex-starved soldiers produced an unprecedented explosion of pregnancy from 1944 onwards that led to my generation being called The Boomers. Although not foreseen, it was quickly recognised….and then ignored for half a century.

By 1950, it was clear to every actuary, demographer and his dog that both the size and age segmentation of the victorious Allied populations was going to change dramatically. It must also have been to the political class, but on the whole they did nothing to address the problem – or plan for the changes. In fact, quite the opposite: the Attlee Government (of whom I remain, on the whole, an admirer) produced information films that were quite staggering hostages to fortune in terms of the promises being made under the banner of ‘Cradle to Grave’ care.

On his reelection to power in 1951, Churchill talked of “setting the People free” from red tape and onerous taxes, while in private warning colleagues that to reverse the Attlee Welfare legislation was unthinkable. Mind you, he also knew full well the horrendous size of British wartime debt….he’d negotiated quite a lot of it. But far from trying to manage expectations, he praised (as a former Edwardian Liberal) the State Pension provision at every opportunity.

The three leaders who followed him – Eden, Macmillan and Douglas-Home – also did nothing. However, where the demographic needs were obvious and immediate – in housing and education – Macmillan in particular put it to electoral use….sweeping to reelection in 1959 under the infamous slogan You’ve never had it so good. The politician uses short-term good news to continue is access to power. Such is, I feel, at the core of the pension provision problem.

I apologise for making these latter points at some length, but they represent the central theme of this piece which, if I may suggest, is missing from Ms Coppola’s Forbes post. That is, pulling out dry Government Acts from the post 1990 era, and suggesting they represent ‘clear warnings’, is unjustifiable in the face of the universal assumptions Boomers grew up with – thanks to the mendacious short-term balm handed out by both Parties from 1950-90.

Those who today call themselves WASPIS were unforgivably encouraged, by almost every politician in the country, towards a belief in cast-iron guaranteed pensions for men at 65, and for women at 60. That undiluted encouragement extended way past even Margaret Thatcher…none of whose administrations even hinted at changing the pension age.

The vacuum of Truth over those four decades is easily explained: the political Establishment knew that any attack on State pension provision or age was electoral suicide. Having created and nurtured the myth of ad infinitum, they cynically chose power over reality: politicians compounded the crime of baseless security by continuing to cover up the crime.

Such is the nature of elective democracy. But in that context, promoting the counsel of caveat emptor not only doesn’t cut it: it is an insult to ordinary citizens to suggest that they should pay for the sleazy denialism of those they pay to tell them what’s what. Even my elder brother Mike – a bloke miles to the Right of me politically – told me way back around the turn of the century, “the first arsehole who tries to welch on my State Pension, I’m off up to the attic in search of Dad’s service revolver”. Like me, he’s comfortably off – he doesn’t need the State pension. He’s also a decent man who detests deceit. For both of us, it’s a question of history and principle. (I’m delighted to record that Mike now has his pension, and so the police, MI6 and GCHQ can reduce their preparedness levels accordingly).

The counter-argument to WASPI accusations of sharp practice has been floated by Frances and others on Twitter as, in précis, ‘entitlement is negated by the fact that NI contributions would never have funded the State pensions of today’.

This I find an oddly obtuse bit of logic. It presupposes that Derek and Linda Boomer sat around all day chewing the fat about multiples of £9.67 contributions made since 1964 while making due allowance for variable inflation and interest rates and changes in the definition of RPI over that period.

I posted recently to the effect that 37 years of helping devise marketing strategies for financial institutions taught me why 9 out of ten Western consumers see money, insurance, pensions and credit as a means to an end….and the jargon that goes with it as both boring and impenetrable. The reason for that is – unlike those of us gripped by this witches’ brew of half truth and obfuscation called finance – they have a real life.

The bottom line for WASPI knockers is “yer shoulda seen it comin’, kid”. Well, I’m sorry, but it just won’t wash. A good contemporary analogy, I think, is that of the banking community (egged on by the likes of UK Chancellor George Osborne) suddenly announcing to us in 2011 that, far from being its customers and/or depositors, we are in reality creditors with no right of redress if and when heavily bonused employees choose to fritter away our life savings on mezzanine investments in tartan paint futures and racehorse derivatives.

Technically, historically and legally they’re quite correct. It’s just that, during half a century of moving my accounts, signing up to income bonds, opening accounts and shifting deposits around, I have no recall of this ever being pointed out to me by any bank employee of any bank anywhere at any time. You see, there is an ocean of crystal clear water between a bank in selling and bailin mode. The same is true of politicians and pensions.

I can remember almost to the month – it was definitely 1978 – when my first private sector assurance client Ambassador Life pointed out to me that there was no State pension fund at all. I’d been employed in advertising for nearly twenty years, with a degree behind me and a supposedly well above average IQ. The client contact – a very nice man with the best of intentions and an enormous capacity for wine – then proceeded to show me that 93% of the UK population also lacked awareness of the hand-to-mouth nature of UK State pension provision. In the light of that it is arch, is it not, to point out that the I in NI stands for ‘Insurance’, not ‘Inviolate’.

In fact, the ever-clever George Osborne recently dropped the NI nomenclature, replacing it with the ridiculous term ‘Earnings Tax’. He has yet to explain to his fellow Brits what the difference is between earnings and income for a private individual taxpayer, but that doesn’t allay suspicions about why he did it…and why his 2013 Budget Speech failed to mention the move. Clearly, his advisers had told him that promising insurance was a bad idea.

That aside, the National Insurance ‘stamp’ (as was) covered three hugely disparate and massively complex life likelihoods – retirement, ill health and unemployment. It is and always has been (until very recently) assumed by the overwhelming majority of the electorate that this one monthly instalment would suffice to keep them out of the unsheltered ditch. Above all else, this gives the lie to any ideas about citizen comprehension of just how big a con this was. Are we now to blame the innocent citizen for political sociopathy? When reviewing such repeated falsehoods spanning 83% of their lifespan, do we pronounce 60 year old women the culprits in this crime? This would seem to me not so much harsh judgement as handy excuse.

That point allows me to segue neatly into the vexed issue – towards the end of this 75 year exploitation of planned ignorance – of what constitutes a reasonable period of notice about change. I would argue that it is on this penultimate issue that Frances stands condemned by her own historical narrative in the relevant Forbes piece. Note this edited but in no way selective or misleading extract (my italicised emphases):

‘The Pensions Act 1995 ended the anomalous early retirement of women, progressively raising women’s pension age to 65….In 2008, the Labour government raised the pension age for both men and women by between 1 and 3 years depending on age…..But in 2011, a new austerity-minded government – under pressure from the EU – brought forward completion of equalisation by two years so that the additional rise could be completed by 2020…. The UK’s state pension has also been radically reformed in the 2014 Pensions Act.’

There are three points to make here. First, Frances rightly states that these changes on the whole benefit women more than men. But second, it has not been ‘very clear’ since 1995 that these changes would come into effect as they have. As she points out, there have been several often contradictory and mealy-mouthed announcements in 2008, 2011, and then yet again in 2014. And third, the idea was to complete the process by 2020: here we are at the start of 2016, and the changes are way ahead of anything projected in 2008, let alone 1995.

In short, the future has been anything but ‘very clear’ since 1995 – it has been muddied and hurried. Far from having twenty years notice, the WASPIs have had at best seven and at worst eighteen months notice.

The net result is that, after between 40 and 45 years of contribution and assumption (depending on educational level) these women were given seven years to work out how to do without six years of promised money. I’d love to be a fly on the wall when any bank, government department, trade union, Minister of State, senior Mandarin, media celebrity or Cabinet Office might be offered such a ‘deal’. It may not represent fraud in a legal sense, but it is cynical, razor-sharp practice on both ethical and compassionate grounds.

Again, the standard “what else would you expect from politicians?” won’t do. What we should all expect as law-abiding citizens – we being the mugs who pay for the privilege of having these gargoyles lie to us year in year out – is something better.

Finally, I find the ‘TINA’ dismissal of alternatives for the future decidedly linear – and too passive given the culpability involved. I repeat: Frances’s assertion towards the end of her Forbes article that ‘it would help if older people stopped making demands for restoration of the entitlements of the past’ because ‘Those days are gone, and the future will be very different’ needs deconstructing.

I have spent a good deal of this post arguing that, far from being plastered with health warnings, the ‘Old Age Pension’ in Britain was for over sixty years positioned as an immutable promise – not on paper perhaps, but certainly through the speeches made – and cultural expectations generated – by the political class. Referring to these expectations as ‘entitlements of the past’ is disingenuous in the extreme. The fact that contributions were woefully insufficient was a fundamental flaw denied and then pushed back by politicians. Changing the pension entitlement with even twenty years to go on a 46-year term (let alone diluting it further until four years before the end) would not be accepted by any regulator in the private sector, and it shouldn’t be here.

The evidence shows clearly that it would not help if older people stopped making demands – because governments deal with passive resistance in the time-honoured manner: they ignore it. Our nurses, police and aged-care workers can vouch for that.

As for the days of old age compassion having gone for good, I think the future is rarely ‘more of the same’. My combined fiscal, economic and social extrapolation from thirty years of Friedmanism in general is that it eats its own customers in the end.

As for the UK in particular, the Conservative Party that so enthusiastically embraces global monopolism now is going to find that history a terrible cross to bear when the chickens come home. Much depends on immensely complex (and at times farcical) sovereignty issues in Great Britain; but mostly, it depends on the unsustainable debt we have and our decidedly shaky banking system on the one hand….and the both divided and divisive nature of the Opposition to neoliberal economics on the other.

There are alternatives, but these are discouraged – as they were in the recent Twitter debate, where pure assertion about how a better way of funding old age provision out of government expenditure was rejected as “impossible….that’s why it was always done out of cashflow”. One hears this a lot in life: ‘It’s so difficult I don’t know where to start, so I won’t’.

In fact, while Frances rightly points up that over 62% of all expenditure goes on social welfare, there are bigger problems with Britain’s expenditure budget than sharing it out.

First, the waste remains enormous, and the Civil Service far too expensive in terms of its wage cost and (ironically) pension commitments. The back-of-envelope ego-trips like HS2 and Connecting for Health over the last decade alone add up to an annual NHS budget. Second, the amount taken in tax from the larger corporate and multinational sector is a scandal going back nearly thirty years, and averages out at a 4.5% net business tax rate sitting alongside a 17.7% rate for the private individual. None of this, of course, includes the vast stagnant pool of tax evaded by higher earners by offshore plans.

[I don’t oppose the idea of larger corporate entities providing employee pension savings schemes by law, but let’s be realistic about the problems: it would be fiercely resisted if any corporate contributions were involved, and governments would back down; the wealth spreads in the UK (and say Greece) are now so stark, there’s no point in a pension scheme 35% of people can’t afford to pay into; and the track record so far of big business in this area is at best weasely and at worst criminal.]

Third, the tax take is suffering from wage levels and hours reduced for the mass of the population, and the continuing inability of the banking system to lend to SMEs, thereby setting up the next wave of growth. This is a failure both of political competence and ideological piffle: 73% of all UK output is in services, and 80% of those are financial; six years ago, Britain’s manufacturing sector was 11%, today it is 8.5%; and wealth has not trickled down to stimulate consumption, it has gushed upwards to freeze it. Unemployment is no longer a numbers game, but the US Congress and UK Parliament pretend it is. The fall in money earned by the less well-off via underemployment is yet another form of the cannibalism that typifies Globalist Friedmanism: less money earned means less tax taken, period.

Finally, the UK’s HMRC has to be the most inefficient, low-quality employee, waste of time tax collection unit on the planet. Possibly the worst one in the Galaxy, but I lack the data to verify that. For obvious reasons I cannot quote the source, but a very highly regarded management systems consultancy reported to the Government at the end of last year that over 80% of all quibbles about and investigations of private individuals during the 2012-13 tax year resulted in a net loss to the HMRC, and of these a staggering three quarters were to do with sums less than £1500.

Every government in the end – no matter how meagre its tax intake – decides how to spend the total. That means they must be accountable for the decisions taken. The record of governments in this regard since 1970 is nothing short of risible, in that not a single potentially pointless cost outflow has been tackled.

From a loss-making relationship with the EU via nuclear defence and ‘sacred cow’ attitudes to yes, the NHS…..all options have been eschewed in favour of cuts in fire services, welfare, ground troops, aircraft carriers, student support, social services, paramedic services, hospital beds available and police numbers. The first duty of any liberal democratic government is to protect its citizens: successive British governments over the decades have chosen instead to protect the status quo, and be as devious as possible about the malign effect on ordinary people.

The idea that ‘there is no alternative’ to a radical rethink on Budget priorities is a myth. For reasons of nuclear portability alone (about which of course we must not speak) pouring yet more money into our archaic nuclear defence system is pure puffed-up strutting on a world stage where our bit-part these days is the old buffoon with no lines asleep in the armchair stage back and left. The NHS must be radically reformed but also protected – from the nasty Troika of Whitehall, Westminster, and Wall Street. The obvious solution is mutuality alongside means testing, the latter of which is claimed to be impossible and yet seems to be a doddle for the French and Germans. The annual upkeep cost of this alone could entirely reshape the use of Britain’s tax take.

My argument is simple but mould-breaking: take more tax, gather it more efficiently, be bold in changing expenditure priorities, cut waste, and above all increase ‘the market’ for paying tax by changing economic strategy. Perhaps Frances Coppola might call this pie-in-a-blue-sky stuff, but then she did write in her recent post about the mid 1940s that ‘Women earned less than men, and their contributory pensions were correspondingly lower. Instead of addressing the problem of women’s lower income directly, they were given an earlier retirement age’. That really is looking at 1947 from the viewpoint of a feminist in 2016, and is perhaps also connected to Frances’s assertion that ‘At this time, working class women did full-time physically demanding jobs, just as their husbands did’ and yet also managed ‘to have a baby every year’.

I don’t think so: after 1939, they were at work in munitions and the civil service, but that was a wartime thing – the average level of all female employment outside the home during the 1930s was 10%, let alone ‘fulltime’ jobs.

As for ‘a baby every year’, well – that would have made the 1944-49 Baby Boom look like a popgun by comparison. It’s hyperbole, nothing more.

°°°°°°°°°°°°°°°°°°°°°°°°°°°

Of all the expectations given a severe drubbing by rigid ideology and greed over the last forty years, the one thing lost above all else is trust. Looking across a spectrum of leaders and providers from all shades of profession is a depressing process. Priests abusing children, police sucking up to politicians, media owners spying on us, Ministers lying to us, equality before the law disappearing, the rule of Law being ignored, ‘reasons for war’ being faked, rates manipulated, commodities manipulated, Bureaucrats and bankers raping Greece, MEPs failing to declare personal interests in privatisation….it goes on forever.

I have said from the outset that The Slog is politically unaligned, and it remains that way because our culture is the problem: mendacious politics and commerce are merely a symptom of the malaise. I do not subscribe to any ideology with the exception of the social and mental secular side of Buddhism, but I do have some solid convictions. Chief among these are first, that somehow – and it is going to be a long process – trust in motive needs to be restored; and second, trust in the principle of accountability needs to be seen to apply to everyone in public life.

Perhaps this is why myself and those in the Frances Coppola camp have an ongoing debate on State pension provision that, at best, sounds like the dialogue in Pinter plays. It feels at times like we are arguing for or against the relative virtues of eggs and mice in the process of constructing a door, where one side wants the door for security, and the other so its windows can let more light in.

No issue is an Island. Frances I feel wants to justify how we got to here and then find a pragmatic solution. I want to condemn how we got to here, and then show how we can make a long-term difference with a more radical realism. For me it is merely another obstacle to put in the way of fascism before it’s too late…..and that option is removed.

Fascism is a vastly overused and rarely understood term: the casual use of “fascist” as an insult by the Left over half a century has resulted in the term now being, for many people, synonymous with little boys crying wolf. By fascism I mean what it is: the fusion of business and State with a view to reducing criticism and increasing progress, efficiency, output, land area, national self-respect or whatever other spurious rationale its promoters choose to come up with.

In the mid 1970s, the UK very nearly fell victim to Stalinist fascism. Today, we are moving towards Corporate fascism of a far worse kind, only this time with universal surveillance behind it. Removing justified citizen expectation is one among many tentacles dragging us closer to the monster’s beak. On the issue of State pensions, Frances chooses to accuse the betrayed recipients of ‘not helping’. I choose to blame the State. I don’t think that makes us necessarily on opposite sides. But it does illustrate very clearly why our priorities (and aims) are different.

Also related at The Slog: When not being radical is an extreme policy