Shock & Awe from the Fed, Pontius Pilate rules Washington & Bankfurt, sloppy Covid19 vapours from the politicians. Summary: to Hell with the fiscal consequences, and SNAFU when it comes to protection of The People.

AMERICAN MARKET UPDATE at 4 pm EDT

Fed money-printing pushes gold back down to $1522. Buy the dip, you can’t lose

Dow bounces 3.5% after record NY Fed slush fund giveaway offer

Fed actions will DOUBLE US National Debt liabilities by Spring 2021

New Covid19 data series vindicates Slog assertion: it’s just a Patsy

The Tangerine Dream in the White House holds the chutzpah record in this collision of crises, in that he’s washing his hands of both of them. How he’s wound up on this unenviable policy road remains a matter for conjecture, but whether one views recent events as “s**t happens” or diabolical conspiracy isn’t pertinent right now: reality is intervening fast.

Time to review the current state of play on this, Friday 13th. [Cue Outer Limits theme]

Yesterday, the New York Fed Reserve made an eye-watering offer of $1.7 trillion to those in the Repo sector suffering from lack of liquidity. Just to be absolutely clear about this, that represents the biggest rebranded QE-style Sovyet Central Planning slush fund in the entire history of Wall Street.

Not enough for the nervous? Nihil desperandum: starting next month, the existing monthly Repo assistance of $500 billion will be weekly for the foreseeable future. This means $2 trillion a month will be available at hyper-cheap rates. That means a total of $24 trillion will be at risk over a 12-month period – and while we must hope that most of it will be paid back, who do YOU trust to do that in the current mayhem?

As is the way with 3M (Modern Monetary Madness) Doctor Death recommends the biggest credit giveaway as the best treatment of a financialised neoliberal system that has become unable to so much as break wind without 2 million megatonnes of credit at unviable rates of return. There might be a clue in all that as to how to deal with Panicovid19. Somehow, I doubt it.

But of course, for the Bourse lunatics, it’s all jolly sound management. Picking up on this ridiculous news, some European markets bounced back this morning CET time. US financial site Barron’s observed, ‘The Dow Is Flying After Germany Does the Right Thing. Now It’s the U.S.’s Turn’. The illogic is mind-blowing.

Is this news or just PR? To take a specific example of this Born Again “confidence”, Apple shares leapt 6.8% following a Wells Fargo upgrade of the stock. Wells Fargo continues to be seen as a likely bank failure as the Bear Market correction unfolds. No self interest here, folks….

Conclusion in a nutshell: the cost of a Wall Street rally in 2020 is roughly equal to the cost of a global bank bailout in 2008.

That’s one helluva rate of inflation.

BUT NOTE: The Fed must be disappointed by the 3.5% Dow rally that proved the futures wrong. And several other markets have failed to react: Canada is down 12.5%, Spain is down 14%, Japan’s down 6%, and the EUROSTOXX index was only up 1.5%.

Handwashing is also the new black at the European Central Bank. Christine Lagarde’s first action as the ECB boss was to say, “Nothing to do with me…it’s down to the politicians”. She does, for once, have a point: the reality is that there is nothing the ECB can do. The slaughter in the eurozone markets yesterday was unparalleled, but rates in the Mickey Mouse area are already -0.5%. So far, in the face of bourse meltdown and Panicovid19, the major EU politicians and Commissioners have slumped into silence. Italy has more or less been told, “You’re on your own, Luigi”.

The other thing to bear in mind with Our Christine, however, is that even if there was something to be done, she wouldn’t know what it was. Perhaps her statement yesterday got confused with Panicovid19: certainly, it did sound like a badly infected central bank declaring self-isolation.

Boris Johnson’s speech of earlier this week did at least say something about what was going to be done vis-a-vis Panicoviditis. It’s just a pity it was the wrong thing. He told us that some of our loved ones (he means me) were going to “go before their time” and that anyone who “feels ill or tests positive should self-isolate for at least seven days”. The evidence we have suggests strongly that (1) Covid19 infects others before the carrier has any symptoms and (2) in some cases the incubation period can be 24 or more days.

BoJo then said that the Government would “review” the idea of closing soccer grounds, theatres and cinemas, thus also ignoring (3) the now agreed reality that the virus is 15 times more easy to catch than either SARS or MERS. If you’re trying to contain such a highly infective agent, all crowds and confined spaces should be the first thing to go.

Rumour has it that the Dept of Health has increased its time-per-handwash recommendation from Happy Birthday to The 1812 Overture. I couldn’t possibly comment.

My own view is that we should take precautions but let the virus do what it’s going to do; it is almost certainly going to do that anyway, and the sooner we have a serum plus signs of burnout, the sooner we can get back to what passes for normal life these days.

The long and short of today’s opener is this: the EU, the Brits, the Yanks, the central banks, the politicians, the media and the public officials are (as ever) light on doey-doey, and lighter still on thinkey-thinkey. At some point, this stereo crisis could easily turn into argey-bargey.

Happily (all things are relative) Panicovid19 itself is beginning to yield more conclusive data series; beyond the media frenzy, there is an underlying trend of key factors suggesting that guarded confidence might be reasonable:

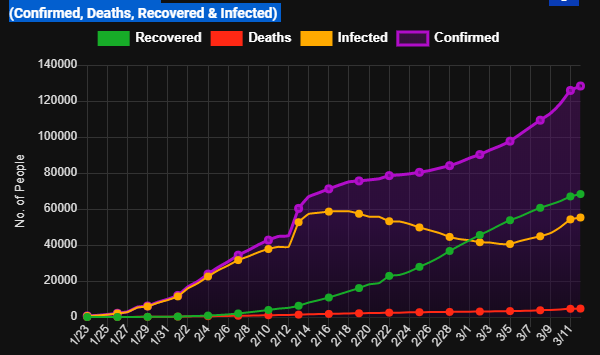

These numbers are from the Covid19daily site which, on initial investigation, doesn’t appear to have sinister links.

While confirmed cases are growing, infections are falling, recovery rates are rising, and deaths are flatlining.

Empirically, the real Covid19 facts are nowhere near enough on their own to cause global bourse meltdown, and a mind-boggling bailout reaction by the NY Fed.

The virus remains a Patsy: whether it was a convenient or planned Patsy, it is far too early to say.

Enjoy your weekend, safe in the knowledge that the 3% isn’t clarifying whatTF Covid19 is really about, and has no solution to the debt crisis beyond the creation of more debt.

This is not a good look.