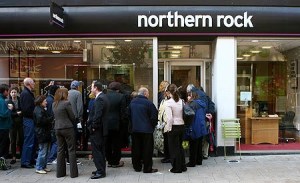

The spin put on Northern Rock’s ‘recovery’ has been largely swallowed by the media. But behind the scenes, we are being deceived in a variety of ways.

‘Northern Rock back in the black’ rang out from yesterday’s headlines and news bulletins. But the reality is that New Labour has been carefully rebranding and shuffling money about to make things look better.

Most news sources focused on the mortgage lender’s net loss narrowing in the fiscal just gone to £309.1 million from £1.38 billion. Now look at the hidden facts and weeP…

ONE

What most hacks missed completely was that its loan from the government rose sharply in the first three months of THIS CALENDAR YEAR. Northern Rock said the government loan increased to £22.8 billion; but only two months ago, borrowing by the bank from the Treasury stood at just £15.3 billion.

The reality is, the taxpayer’s exposure has gone up by 50%

TWO

Outstanding toxic debt at the Rock also leapt ahead by £200 million to £1.1 Billion. Quietly in the smaller print, the management accepted that it ‘expected loan impairments to stay high in 2010 but to fall below last year’s peak’ – ie, the bad debt ain’t going away.

And remember, Northern Rock paid back just 6% of the Government loan last year…far less than the extra it borrowed.

THREE

Alistair Darling suggested yesterday that these 2009 results mean the taxpayer could ‘be repaid from the bank’s old mortgage book’…which Treasury officials said was being ‘wound down’.

Correct – which could take up to 20 years. Because that’s how long people take to repay £54 billion of mortgages. We must now wonder – in a climate where interest rates must rise and relief for struggling homeowners is to be removed – how much of that whopping sum will be paid back on time…or at all.

FOUR

Also note that 100% of the ‘good news about Northern Rock’ can be trumpeted because there is another entity (within which we are in over our heads) called Northern Rock Asset Management. Subtle name-change there: blunt debt reality, no change there. Over 90% of the taxpayer equity risk is in this bad old Bank.

FIVE

Depositors are to lose their savings guarantee with the Government on Rock deposits completely….just eighteen days after the General Election.

Now, I wonder what that will do to deposits?

PS Anyone spotted a Tory strategist on this case?