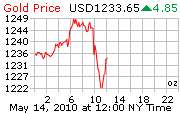

Another sudden gold correction for no reason…..on the dot of

NYSE opening. Just fancy that.

Veteran followers of nby and the gold manipulation saga will recognise the above ADVFN graph as the very familiar sight of somebody very, very big indeed mucking about. So apologies for the poor devils who’ve heard all this a hundred times before.

The thesis behind nby’s suspicions (now inherited genetically by The Slog) is based on the following incontrovertible facts:

1. In Spring 2009, the Chinese People’s Republic up and announced it had trebled its gold reserves….overnight. “We dug it out of the ground” they said. Oh how we laughed.

2. Before that, nby insisted time and time again that somebody was selling gold bigtime. Otherwise, how was it that every time the world looked as if it might be pointing mammory glands skywards, the gold price kept being capped by massive selling? (This despite the fact that ringing bullion dealers evoked the response “Can’t get it for love nor money, Squire).

3. The selling always takes place on the dot of NYSE opening.

4. Last week President Obama rang frantically all round Europe’s capitals. His message was simple: promise to get deficits in order or we’re all dead.

5. In Eurozone bond and credit trading this morning, the 99% market sentiment was ‘the EU is going broke’. Gold rose another 18% to just a gnats under $1250.

6. At 30 seconds past ten NY time today, the gold price fell off a cliff. It stopped falling at $1222 – the Fed having decided (presumably) that a 28 bucks drop in 55 minutes was more than enough.

7. On 9/11 – the most confidence-shaking day in US history after Pearl Harbour – the gold price fell just $4.64.

8. Today, all markets and most commodities were falling – apart from gold. The Eurozone uncertainty was by far the biggest factor in that….and nothing substantive has changed. So why the sell-off?

Don’t tell me ‘profit taking’. First, this is the wrong time to take profit; and second, at that level of drop, there would have to be a seller so massive…..er, um…..

My theory is that the US is selling deep reserve (Fort Knox) gold to the Chinese via the markets….a strategy that suits Beijing down to the ground – and one which is force majeur for the Americans.

It muddies the waters on an overpriced dollar. And ensures the Chinese don’t get too pissed off about the USA’s true declining currency value.

Hint: at precisely the moment gold began to plunge, the Buck rose. It finished the day 1.2% up. Job done. Everyone happy. Except the innocent saps investing in gold.