I apologise once more if some of our longer-standing readers are bored with the Slog’s major gold obsession, but bear with me because this time I have further news – and more evidence.

I apologise once more if some of our longer-standing readers are bored with the Slog’s major gold obsession, but bear with me because this time I have further news – and more evidence.

Since 2006 – when nby first began asking questions about the gold ‘market’- I have maintained (along with thousands of other investors) that the price of gold simply does not behave like a free market should. You can zap along to the 2008 piece (which covers most of the ground) in order to catch up, but the bottom line is this: the price quoted for gold on the main American, European and Asian markets does not adequately reflect the voracious appetite there has been for it since around late 2005; and whereas nobody important has been in Fort Knox since 1951, the one thing we know about China’s reserves is that they’ve trebled in the last eighteen months.

These may seem like random facts, but they aren’t. The likelihood is that somebody has been dumping gold onto the market to contain the price and defend the dollar; and somebody has been buying that gold to diversify and balance the huge surpluses it has been generating for more than half a decade. Those culprits must be the USA and China respectively.

The ‘price’ of gold remains at around $1225 an ounce, and that price has been volatile throughout the whole period in question. But whatever the price, ring a bullion dealer and you’ll be lucky if you can amass more than a dozen ounces in any given week. Often, they have none at all. There has never been a demand for gold to match the clamour of recent years – but the price has remained resolutely below $1250 an ounce….and often much lower.

This morning, the Financial Times wrote a piece in which this key paragraph appeared:

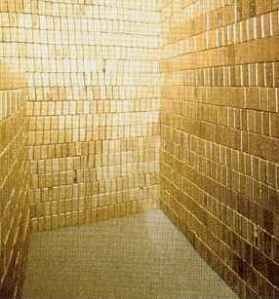

‘Some of the world’s biggest banks and security companies are building vaults to store gold bars and coins worth tens of billions of dollars, cashing in on resurgent demand and record prices. The growing interest in gold among investors worried about the global economy and Europe’s sovereign debt crisis has led to a shortage of long-term storage space.’

Exactly how the price is being capped is not something I believe anyone can be sure about. There are variables that explain some of the sluggish growth in prices: the Chinese are digging more of it out of the ground (with South Africa’s technical help in return for vast investment in SA). Some central banks have sold the metal in recent years. And our own Chancellor Brown, as we know only too well, sold a shedload at $230 an ounce in 1999.

But several things have been impossible to explain away – although the authorities have tried. The first is the huge increase in Chinese reserves. Up until six months before the miracle of trebled reserves, Beijing denied it was buying any. The second is the enormous discrepancy between the Bourse-defined total in play, and what has been produced and stored in recent years. And the third is why gold isn’t at about $5000 an ounce by now.

Central banks reportedly have 32,000 tons of gold, with the International Monetary Fund accounting for just under 3000 tons. Under the Washington Agreement on Gold, its members can only sell a maximum of 400 tons a year – thereby restricting the amount of gold on the open market.

But the Gold Anti-Trust Action Committee (GATA) argues that central banks in actuality have less than 15,000 tons of gold – and that the missing gold has been secretly dumped onto the market, preventing gold prices from rising. This both defends currencies (mainly the dollar) and stops a stampede out of equities….which would bankrupt the economy.

The key to what’s happening has to be the USA’s so-called ‘Deep Reserves’. With blase condescension, the Fed argues that its reserves are there for all to see, and there have been no massive sales. But Fort Knox (where the deep reserves are held) is entirely separate from Federal reserves. Big K hasn’t been publicly audited since 1957. And no President has even set foot in the place for sixty years. For all anyone knows, there could just be a mountain of Terry’s All Gold or Benson & Hedges in there.

Some of the wilder theories suggest that investment banks have also acted for governments (chiefly the American one) in using metal futures traded at a bearish price to dampen sentiment. I’m unconvinced by this one personally: but conspiracy theorists use it as a way to explain why banks evade prosecution – and have limitless access to free taxpayer monies when things go belly-up.

I repeat: I’m not a conspiracy theorist, but I do listen when there seems to be an overwhelming motive to do something. Means and motive abound for the Americans to dump gold and the Chinese to buy it: defending the currency and the economy’s capitalisation makes sense for Washington, while buying up gold in a world where foreign debt and other investments look dodgy is a no-brainer for Beijing. Commonsense would make me ask, if they’re not doing it, then why the hell not?

However, all over the world the ordinary investor keen to do nothing more than protect and maintain an existing wealth value is being cheated here. There’s nothing new in that: but it doesn’t make it any less of a disgrace.