Yesterday was an important one for global fiscal and economic matters, and not just because the US financial government system showed itself to be as corrupt as the banks it so clearly represents.

On the basis of poor US growth figures for the quarter, the Dollar plummeted. Concerns about slowing Chinese growth (and a more studied reading of the ECB’s lending data in the eurozone) sent every other major currency on the road down to Rio.

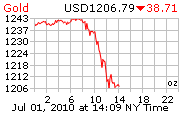

But here’s a thing: despite the Buck diving, Gold dived too:

My own view is simple: if people are nuts enough to sell gold, that gives the rest of us a chance to make even more money out of it in the medium term….and as we don’t get many chances at revenge on the bastards, why not?

Nearer to home, another psychological connection that more or less went by the board yesterday was the FTSE’s desire to defend 5000. The UK’s main index had been ducking and diving around the magic number for quite some time, but yesterday it failed to rally and wound up dropping 111 points down to 4805. So where now? This is what leading wealth managers Full Circle told its lucky clients last week:

The yo-yo period referred to by The Slog in late May is now (I think) drawing to a close. There is too much complexity, incompetence, fear and disturbing data out there; and too much debt, junk-buying, squabbling, crookery or denial for there to be any way back in a hurry.

The straw-clutching days are upon us.