The commercial and economic world is not a happy place tonight. In a gob-smacking piece this morning, Ambrose Evans-Pritchard of the Daily Telegraph revealed that the Spanish fiscal system is virtually eating itself, as the Government there gambles away the pensions and health insurance of its own citizens in a bid to buy its own bonds and thus keep the otherwise terrified punters interested. I’m sad for the Spanish but delighted for the Slog’s reputation, as I rather fancy some were beginning to doubt my trusty source on that market. He’d told me two months ago that what he called “incestuous buggery” was taking place in the country’s financial mess; well, now I can see what he meant.

Ambrose’s column has become a winner for the Slog, attracting many people of sound mind to our continuing story of economies melting down gradually over a cliff safely to the jagged rocks below – only to discover that the incoming tide is nitric acid. So it was the first place today that I broke the news of the rather odd behaviour of Barclays (a) in the stress tests and (b) while on holiday in Italy.

This is a bigger story than most realise for a number of reasons. First off, even I hadn’t included Big B in the bailout club. I still don’t, but all the same one is bound to ask why they lied about the loans in the stress test, allegedly. Second, it backs up the Slog’s contention of last June that somehow Italy has managed to avoid the ClubMed limelight – despite being (according to reputable sources) perhaps the worst case in the EU. And third, the flat refusal of two of France’s biggest banks to even consider publishing any more sovereign liability does point to all kinds of awkward conclusions……which even Christine Lagarde’s long division couldn’t solve.

For the first time I can remember since 2008, the world’s major stock markets were all straight reds today of 1.5% or higher. The key ‘recovery commodity’ oil continues to head south, and at the start of NYSE trading today, Gold leapt $21 in the first two hours: it’s now nestling at $1230.

It is a fact that seven of the last nine US recessions have been overcome primarily by the return of a Bull property market. This isn’t happening at all in 2010: sales slumped back to a 15-year low there, and in the UK both domestic and commercial property lending plumbed new depths. There will be carnage in the commercial sector before too long, and at least one pension supplier will fall victim to it.

The shrinking public sector already means that all over the UK, suppliers of goods and services to it are going bust. My Dad was a victim of this during the original Thatcher Cultural Revolution after 1979, but he didn’t mind because, being a patriot, he knew it was what the country needed. His patriotism was also galvanised by having a very healthy savings account and a private pension in the good old days of 12-fold annuities. New Labour will within days be whining “I told you so”, but one could explain lending market realities to the Huttonites until the cows came home having made their own cream, and they still wouldn’t get it.

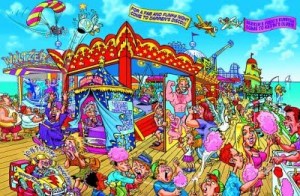

In Japan, the Nikkei came perilously close to pure Bear territory, not helped by its increasingly bizarre branding as a currency safe haven. Commentators have been asking since early 2009 how long that status can last, but in the absence of a safe dollar, pound or euro, it may be that the sons of Nippon are stuck with this millstone for some time to come yet. If I was them, I’d start borrowing like mad from China. The result would be cash in hand to restructure industry and a falling Yen to help exports. But if it was that easy, everyone would be doing it….and nobody wants that. This is the End of the Pier Show that is globalised capitalism: a system claiming that everyone wins, but currently faced with a reality in which nobody does, whatever they do.

This applies even to China itself – and especially to its haulage contractors, many of whom have been stuck in the world’s oldest and longest traffic jam for some time now. The thoroughfare – Highway 110 – has a bottleneck which passed the ten-day mark today, forcing local authorities to dispatch hundreds of police to keep order, and reroute cars and trucks carrying essential supplies around the main problem areas. Starting on the outskirts of Beijing, it stretches all the way out towards the border of Inner Mongolia – a distance you could wrap round the M25 a great many times.

Beijing is closely followed for traffic delays by Moscow, Mexico City and Johannesburg, the last of these being a place where you really don’t want to be stationary in your car for too long. Perhaps Joburg has caught the Chinese infection, because the Beijing regime continues to pour trillions of Yuan in investments into the country….having eyed it long ago as good colonial material.

The Slog and its predecessor nby have been posting about the Chinese annexation of South Africa ever since Warren Buffet was knee high to a carpet-bag, but much of the world continues to ignore the process. South Africa’s trade minister Rob Davies rejected criticism of China’s massive involvement in the Rainbow Country yesterday, asserting that it “can only be a good thing”, but without actually countering any of the evidence that it might be a very bad thing. Former President Mbeki disagreed: he issued a public warning three years ago that Africa risked falling into a “colonial relationship” with China. But Mbeki is history, and now that the hard-core nutters are running what was once the Great Hope offered by Nelson Mandela, it’s all aboard for the Beijing Gravy Train.

A delegation currently led by South African President Jacob Zuma to Beijing includes more than 370 business executives and 11 cabinet members, making it the biggest ever group to accompany a South African leader abroad. Zuma is big on biggin’ it innit, and averred that “China is indeed a key strategic partner for South Africa, and South Africa is open for business in a big way”. The inevitable decision by Beijing one day to tell Jake where to stick his machine gun is the sole saving grace I can see in its South African takeover. It is just one small fragment of the surreal tapestry that was world geopolitical business and banking on this day, the 24th August 2010.