30 YEAR BOND/QE2 DILEMMA WORSENS

GOP/Tea Party debt politics are playing with fire.

UPDATE 14.15 GMT: NON-FARM PAYROLL INCREASE ONLY 20% OF EXPECTATIONS, 30 YR BOND YIELDS NOW AT 4.69%

OK, it’s another post about the US, but listen up: if you’re British, trust me – this piece affects you directly. (Whatever your nationality, it affects you. Especially if you’re Chinese.)

There’ve been two posts at The Slog in recent days on the US debt/QE stimulation dilemma. The first said that signs from Bernanke about QE being continued would result in higher yields on US 30-Year Bonds. These are the ‘safest’ investments you can make in US debt. This is what happened when Ben the Banker confirmed QE2 continuance:

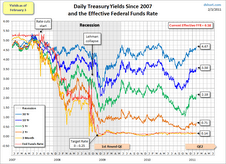

Thanks go to sharp website Zero Hedge for that little mother. As you can see, demand for 30’s fell off a cliff. As we posted earlier, the yield edging up to 5% is a sell-sign for the stock markets. This chart from equally clever site Wallstcheatsheet shows the trend in all US bonds in recent times – it’s hot off the press:

Opera glasses recommended for this one – the top line is the 30s bond

Opera glasses recommended for this one – the top line is the 30s bond

After Bernanke’s confirmation of continuing QE2, 30’s yields edged up to 4.67%. In fact, all bond yields (as you can see from the chart) did that. Ever closer to the demonic 5% for 30 year bonds, the trend vindicates what we said was a likely outcome in the short to medium term.

The second Slog post on the subject looked at Congress v White House politics on the US debt ceiling. Yes folks, the US is now such a basket-case debt addict, it could reach its ceiling some time towards the end of April. It needs Congressional permission to raise the ceiling. And it no longer controls Congress.

This is, to some extent, standard knockabout checks-and-balances politics Washington-style. The only difference this time is that the Tea Party folks are involved on the anti-Federal spending side, and they are to Big Government what Al Q’eida is to the existence of Israel: there isn’t a lot of sanity involved in the analysis.

Now if, for instance you believe that onanism is a sin and God created everything 10,000 years ago in six days flat, there’s every chance you won’t understand how the debt markets work. And what seems to you like a smart way to get Obama’s testicles firmly in your grip could very easily result in a panic the like of which we haven’t seen since 2007 1929.

Add this to a market made nervous by the proximity of 30 Year Certificates towards 5%, and we could easily go from incremental to excremental in short order.

The S&P index is bobbling sideways in a small 10-point range. Today’s Friday, and it’s time for The Big One: non-farm payroll data: is this still the jobless recovery, or are things looking up? We’ll probably know just after lunchtime GMT.

Stay tuned.