In a spirit of Sovereign forgiveness, The Slog recommends spanking the banker’s bottom line

What do you do if you have a terminally ill patient who you know will die, and the only thing left is a new cure which might very easily kill that person? It’s easy, isn’t it – you offer them the cure. And the patient grabs your hand off.

But what if, in the same situation, you offer the patient leeches, which have in the past been shown to hasten the sufferer’s death in an even more undignified and painful manner? The patient may buy into it; but the relatives will try and stop you administering blood-suckers.

This is a sort of parallel for what’s happening to Greece at the moment. The patient would rather do anything than die, but its citizens have seen the movie before: “No, no,” they cry, “anything but the leeches”. Unfortunately, the medics involved here are the EU (which understands budgets and timescales, but not much else) and the IMF (which understands only monetarism – and nothing else).

The IMF has many implements in its doctor’s bag, but just the one solution: the leeches. Under Dominic Strauss-Kahn – a social democrat euro-nutter – things were slowly beginning to change. But DSK is now on trial for his career, and so the cure remains that offered to Hungary. It’s the same leech thing, in fact, that Hungary turned down last year.

The social democrat understands how to spend, and the monetarist knows how to cut. Neither of them know how to be creative in a new situation….yet this is the problem the world faces at the moment. And down the road, there is going to be a real world far beyond Greece.

Perhaps what we need to do is present one or two undeniable facts, and then try to move forward from there.

Look at the world financial debt aggregate in 2007, and then tot it up for 2011. There is considerably more debt in the banking system today than there was four years ago. As The Slog has repeated endlessly, deleveraging simply has not taken place…if anything, the opposite has happened.

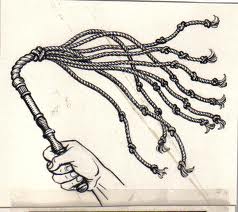

Thanks to the irrefutable reality of such bankers with severe learning difficulties, a sorry group of finance ministers and long-suffering Greeks are now being whipped and whipped until they drop. The reason, as we have seen, is to save the lending policies of Franco-German banks, and the equally braindead insurance policies of Wall Street CDO providers. If they drown, they say, we are all doomed.

Many of us would conclude very differently by saying “What’s with this ‘we’ paleface? What it would represent is a good start – now for the lawyers”. But the key question is surely this: why do we have to assume drowning?

Think of it this way. The prelude to all hyper-inflation in the past has been uncontrolled leveraging of debt. Banks overreach themselves, and call upon governments for help. Governments panic; they print money, buy assets, and bite their nails even while asleep – all in a bid to save their banks. Leaks about government panic hit the markets, which dive. So to shore up the bourses, more government (aka taxpayer) money is required to provide cheap liquidity and – unfortunate side-effect – cheap gambling money…which goes on mergers and stock market punts. Neither of these create jobs or rejuvenate economies: what they do, in fact, is pump up the Dow and every other Bourse on the planet to an unsustainable level. More leveraging, more inflation, zero rates, hyper-inflation and aaaarrrrg.

But suppose sovereign debts become so ‘unrepayable’, the debtor governments blackmailed the banks into forgiving a huge proportion of that debt? As in, “Fine chummy – demand your money back. But if we implode, so do you”.

The Greeks are at present confused by the eclectic range of guilty parties telling them what to do. They should ignore the IMF and the EU, and focus instead on the credit providers: help us survive, they should say, and there is no reason for you to drown. Become sanctimonious, and you will surely join us for a merry party down in Davy Jones’ Locker.

This isn’t as daft as it sounds. With widespread debt forgiveness, automatically the banks deleverage. That is to say, they offload a huge amount of toxic liability. But not onto the taxpayer – and not enough to produce insolvency. It is written off, to a place far, far away where notional money lives.

The whole shooting match then becomes a judicious balance between a debt level the Sovereign can withstand given its economic outlook – and a write-off level the banks can stand without going down.

The loser is the bank’s bottom line…..and the Holy Shareholder. I think regular Sloggers will know my answer to that dilemma: no dilemma there in my book. Global shareholders have had a good run for their money: now it’s our turn.

On a macro level, the almost immediate result of such a policy (if it caught on globally) would be a decrease in the inflation rate; or, if you’re a French government minister, the amount of oral sex available*. The inflationary influences would be massively reduced by a zero need to buy bad assets and print money. And – as is only right and proper in a sane world – attention would then turn to reforming the economy’s imbalance, and increasing output in order to avoid the next potential hazard – deflation.

Let’s not beat about the bush here: some banks would collapse. What’s more, when it came to US debt, the Chinese would get seriously uppity. But the economic and social systems we enjoy would survive….and wealth transfer to the developing world would take place at an acceptable speed, rather than as a result of catastrophic insolvency in the West – which could only be disastrous for the Chinese in the medium term.

To err is human, and to forgive is indeed divine. I have long believed, however, that alongside the divinity of forgiving sits the stupidity of forgetting. The whole crazy circus would start all over again unless a new and globally defined regulatory system was applied to both sovereign debt-to-gdp ratios, and bank-liquidity-to-lending relationships. And (in my view) a key element for future, more balanced and sustainable economic development would be a greatly reduced reliance on the Bourse/remote shareholder model….with much more emphasis on proximity shareholders in mutual groups, and community start-up capitalism.

We are Homo sapiens, and we show no signs of evolving. On that basis alone, dramatic climate change might be just the ticket. More seriously, Hobbes said that human life is nasty, brutish and short. We have proved him wrong on the short bit: now lets see if we can be nicer without too much compromise on the greatest happiness of the greatest number….the target set by my ultimate hero, Jeremy Bentham.

—————————————————

* Former French Justice Minister Rachida Dati mixed up the words “fellatio” and “inflation” during a TV interview recently. The two words sound very similar in French. She told Canal Plus: “I see some funds looking for returns of 20 or 25% at a time when fellatio is close to zero.” The video of this gaffe remains a firm favourite on YouTube.

The Slog gratefully acknowledges the value added to this piece by Full Circle Chairman John Robson