Glasers…not slugging it out in Singapore

Glasers…not slugging it out in Singapore

Man United’s owners stop Singapore IPO as global outlook goes into neutral

It’s beginning to look like George Osborne’s austerity isn’t stimulating enough; could be that it’s a nail-biting wake-up call, or perhaps merely Cameron worrying that markets might fall on debt fears or then again rise on fading crunch anxiety. Nobody knows: as the FT headed its overview this morning, everything’s a bit ‘mixed and cautious, but with a slightly bullish tinge’.

Financial journalism these days has become as lazy as its tabloid equivalent. I have long felt that there is only a tiny amount of real news per 24 hours, and that the tabloids invent the rest. It’s beginning to feel like the qualities – while not making it up – are dealing with the fact that, between disasters, nothing much happens in real terms: global meltdown has become a series of predictable events. The only interesting bit left to write about – until we actually go over the cliff – is what happens when we hit the bottom. But in the meantime, cliches are the new insights: we are all mulling, hardening our stances, and refusing a haircut.

It was notable at even this site yesterday that the enthusiasm for commenting on our funereal procession towards an economic graveyard was on the wane – and the hits were down too. I don’t blame people for this; but I refuse to post ‘updates’ in the absence of anything interesting to say. If one’s not adding value, why post?

The two ‘unknowns’ at the minute aren’t unknown at all: Bernanke will announce something at 7.15 pm BST, and it will almost certainly involve more indirect cutting of long-term rates. And Greek negotiations with the Troika are ‘proceeding well’….what else were they going to say? Greece is a cadaver already, Italy is on life-support, and the Federal Reserve is both split and lacking weaponry. What’s to know?

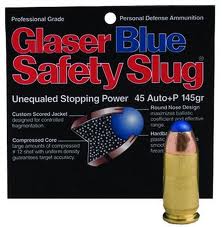

So today, after a sleepless night of reading and research comes this revelation: The Slog can offer you lucky people a world exclusive: no less a scoop than the imminent launch of the Glaser safety slug.

The launch ad (featured above) asserts that nothing has the stopping power of the Glaser slug, and as a Manchester United fan I find it impossible to disagree with that claim. For the Glasers are indeed slugs, and their stopping power is sans pareil. They put a stop to United’s debt-free status in record time, they put a stop to major transfer deals for several months two seasons ago, and they stopped any access United could have to Bourse funding by taking the company private. They then put a stop to proper accountancy reporting by moving the holding company to Delaware, which as you know is quite close to Manchester. And finally, they stopped a lot of ordinary fans being able to afford the season ticket prices.

The launch ad (featured above) asserts that nothing has the stopping power of the Glaser slug, and as a Manchester United fan I find it impossible to disagree with that claim. For the Glasers are indeed slugs, and their stopping power is sans pareil. They put a stop to United’s debt-free status in record time, they put a stop to major transfer deals for several months two seasons ago, and they stopped any access United could have to Bourse funding by taking the company private. They then put a stop to proper accountancy reporting by moving the holding company to Delaware, which as you know is quite close to Manchester. And finally, they stopped a lot of ordinary fans being able to afford the season ticket prices.

In their defence, the Glaser slugs claim to have put a stop to Manyoo being at the mercy of the stock market’s idiosyncracies, and there is a degree of sense in that. But they stopped having that idea last year when it became apparent that even United’s cash-flow couldn’t withstand the Tsunami of debt heading towards the club from the cryogenic family’s various bizarre business interests. So instead of protecting United from sharks and vagaries in the stock market, they thrust the Reds into an Asian cock-fight just at the very moment the global finance system looked on the verge of going tits up. And just to be on the safe side, they proposed an IPO with a two-tier share structure, in order to stop anyone with the clubs best interests in mind from taking it out of their greasy hands.

But as of yesterday, they put a stop to the launch plans. Largely because an awful lot of advisors told them that, in the current environment, the launch would almost certainly be a dud. Which to be frank, even a relative layman like me could’ve told them three months ago.

Anyway, with the Glaser Slug, what you see is what you get: as the ad says, you get unequalled stopping power.

There’s a fair amount of punch to their fibbing power as well. Although claiming yesterday that ‘talks with cornerstone investors are still proceeding’, I can tell you that they aren’t really. Two reasons: first, the thirst for risk is declining almost everywhere with each month. And second, in a bearish world, the Glaser greed behind the deal is all too obvious. At last, institutional investors are exercising a degree of caution….and long may this continue. Happiness is no longer a warm gun – and thus, the demand for slugs is falling.

Late Flash: Leeds 0 United 3