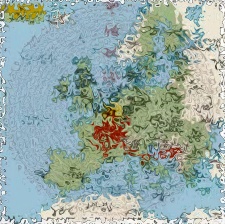

Toxic debt fear spreads through the EU by every means

Toxic debt fear spreads through the EU by every means

As quickly as Germany tries to sew up EU integration, the markets are picking off the weaklings

Eurozone bond markets suffered a mass sell-off on Tuesday as investor fears spread beyond Italy and Spain to triple A rated France, Austria, Finland and the Netherlands. The premium that France and Austria now pays over Germany to borrow has risen to the record level of 192 basis points.

Mike Riddell of M&G, one of Europe’s biggest fund managers, called it “probably the most worrying day” of the crisis so far.

“It’s a confidence crisis,” said Elwin de Groot, a senior market economist at Rabobank Nederland in Utrecht, Netherlands. “Investors have no confidence that the euro zone can solve its problems. They will look for the most safe place they can store their money, which is Germany. Everything else is suffering.”

Italian yields moved back through 7% – a level viewed by pundits as unsustainable – for the second time in a week. The Spanish premium to Germany hit 482bp, above the critical 450bp rate at which Irish and Portuguese yields spiralled out of control and forced both countries into bail-outs. Even Belgium saw its bond spreads over Germany reach record levels.

Mariano Rajoy, the Spanish opposition leader expected to win the country’s general election on Sunday, insists that the next government will do whatever it takes to preserve Spain’s eurozone position. “I believe in Europe, I believe in the euro project,,” he said. “ I want to fulfil the tasks that we all need to do as members of the euro.” I continue to wonder why.

Trading opinion leaders offered frightening views of a non-market in bonds for some countries. Only the European Central Bank was active in Italy and Spain yesterday. “It is really scary,” said one person at a US bank. “Everyone is liquidating in the eurozone bond markets……Everyone is heading for the door.”

The situation this morning is that – as The Slog reported last night – Merkel and Schauble are engaged in a headlong dash to reassure the lenders via ‘instant EU unification’, and technocrats are installed in Greece and Italy to create ‘instant deregulation’. But the markets are faster than either of these events….even if they could be achieved.

The default-fear virus is spreading out of ClubMed and into the heart of Europe.

The ECB needs to “cut rates, now, and do something serious about helping governments, or the euro project is over,” Soeren Moerch, head of government-bond trading at Danske Bank A/S in Copenhagen, wrote in a note to clients yesterday.

But Merkel remains implacably opposed to either this or the eurobond concept. In a surreal game of one-a-side underwater rugby, nobody is even sure any more where the ball is. Germany is both fighting and pacifying the markets at one and the same time. Can she win a war on 17 fronts? It seems unlikely.

But what will be left for the victors?