But sources are “95% sure” a deal will be done

But sources are “95% sure” a deal will be done

In a slightly barking bit of brinkmanship late yesterday GMT, Greek Prime Minister Lucas Papademos told the Greek media that, if necessary, he would introduce special Greek legislation to force bondholders to the agreement his Athens Government needs. Quite how you can ‘force’ anyone to do a deal without storing up serious repercussions down the line is a bit beyond me, but it is beginning to look like some form of bargain will be struck in the next 36 hours.

“It [legislation] is something that has to be considered in the light of expectations about the degree of the participation to be achieved,” Papademos told reporters, “It cannot be excluded. It is contingent on the percentage.” Seems to me like he is playing hardball with a ripe tomato here, but anyway a deal to save face for both sides is in the offing.

What’s happening here is debt restructuring by the Greeks, but nobody must mention the r word, otherwise Mario Draghi will combust mysteriously. The Government wants the creditors to swap the maturing bonds for new ones, which when I was at school was called putting the payment date off aka can-kicking aka debt restructuring.

The sticking point is what interest rate (or yield, depending on how they do it) will be offered. My best guesstimate is that the Greeks will get the front-end 50% haircut they want, and the Hedge Fund led revolutionaries will blag a higher yield than Athens wants to give. I’m thus far unable to ascertain how far down the road this particularly badly dented can will be kicked as a result of the coming negotiations. I suspect that nobody knows as yet. But I think that the ‘net’ write-off by bondholders will be circa 70%. That’s still not enough to make an appreciable difference…and of course, for those risk-taking hedgies who bought the junk for next to nothing, they could now sell on at the new value and make a very healthy turn on it. Or not, as the case may be. My prayers are on ‘not’, but I’m not sure God is listening much these days.

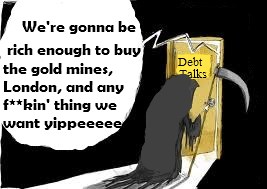

Either way, apart from potentially making half a dozen New York hedgies potentially rich enough to make Warren Buffet look poor, the result is only important in its potential to delay a default so that Berlin can make its mind up WTF to do next so that Greece can recover, undergo an economic miracle, and go on to enjoy growth outstripping that of China in order to repay the debt.

It’s a sick joke, and the folks mainly sick of it are those Greeks being asked to take yet more cuts in their living standard so that French banks and American wheeler-dealers can remain in clover. About half the nation was on strike yesterday as the Troika arrived to look at the books again and – if the haircut deal is signed – release more money so that Greece can stumble on pointlessly to the next deadline.

A radical combination of debt and lending forgiveness by central banks and sovereigns would be far less costly, and infinitely more effective. But there are fortunes to be made here, so that won’t happen. I very much doubt whether any of the happy New Yorkers and grey Troika bean-counters have factored in the risk of serious violence; but then, that’s their lookout.