…..but Wall Street’s wobbly wide boys are wearing fewer and fewer clothes

“The underwriters got greedy on behalf of selling shareholders and bumped the price high enough that they didn’t get much of a bump on the first day,” said Bill Smead of Smead Capital Management told Reuters last Friday, adding that “They increased the size of the deal and that really did a number on it.”

Well said Mr Smead. Lets rewind a little on this one and examine the ratios involved.

At the height of the gr insanity in the mid-1980s, a valuation to revenue gearing of 30:1 was seen as normal by the mad folks, but slightly bonkers by the conservative traders who were still around trying to add a dose of reality to the New Paradigm pillocks.

The valuation to revenue rating put on Facebook at its IPO this week was not far from 30:1. A quarter of a century on, the markets have learned nothing. Well, that is – they have: but what they’ve learned is yet more bad habits whereby a piece of paper deriving from the value of a Matchbox Toy antique from the 1960s has been ‘leveraged’ to a position where it is worth $40bn.

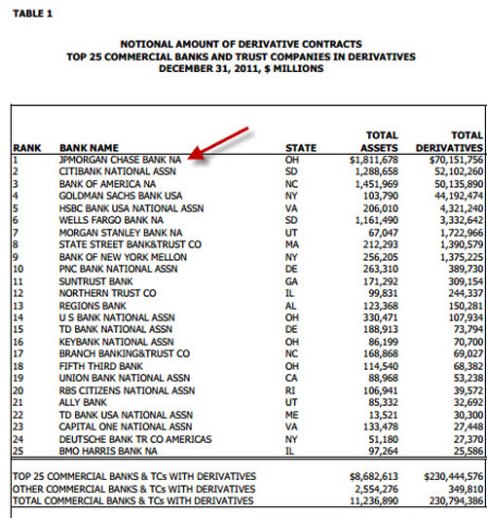

You think that to be an exaggeration? Take a look at this table showing audited comparisons between the assets of top world banking concerns, and the derivative obligations they could face:

The arrow pointing to Morgan the Pirate there merely highlights the current spotlight on derivative cock-ups that already cost Jamie Dimon’s cowboy outfit $2 billion last week. But what this table does is create a new gearing relationship of assets to obligations. And as such, it makes even the top end of traditional IPO gearings look like a gentle walk in the park.

None of this information is new, by the way: if anything, that’s the disturbing part. This sort of reality has been around for quite a while….it’s just that nobody in authority’s paying a lot of attention.

Examine those derivative to asset ratios and weep.

JP Morgan, 35:1, Citibank 40:1, BoA 32:1….Goldman Sachs 450:1. The average across the major US banks’ office is roughly 25:1.

And bear in mind….these ratios have much more profound consequences than a few rich folks failing to get the greedy IPO returns they were expecting. A tiny percentile degree of calling in such obligations would result in the US banking system being flattened.

A 0.25% realisation of Goldman’s crazy exposure would wipe out its assets. A 3% realisation would take JPM, Citibank, and Bank of America off the table….along with pretty much the entire global banking system.

I do hope I didn’t spoil your digestion for Saturday night out. But equally, I do hope just a few of the denialists might, as a result of this piece, pull the fingers from their ears and get real.