US debt, bank black holes, and gold due for another chute

Will it go below $1000 this time?

Will it go below $1000 this time?

In order to taste the truly madly sour flavour of delusion, you could do a lot worse than read Philip Aldrick’s column in yesterday’s Daily Telegraph. The header – “Greece edges closer to sustainable public finances” – tells you just how silly it’s going to be, but doesn’t entirely prepare the reader for the poorly-informed, robotic nature in which Aldrick has once again soaked up the Party Line….as if he were some form of synapse-free blotting paper.

Mind you, it would hard to beat this pearler from yesterday’s FT comment columns:

“US stocks are hardly overpriced. Their forward p/e is about the average for the last 50-60 years. Besides US companies have very strong balance sheets and EPS is partly pumped up by share buy backs. I don’t see any particular reason to fear a stock market crash. If it happens it will be a silly crash and a truly amazing buying opportunity.”

Jargonised dingbat misses page one: the P/E is irrelevant if it’s based on financially derived rather than manufacturing profit, you moron.

So I thought I’d try and breathe a little more reality into your already careworn day, dear Sloggers. Let us turn first, as William Hague always does, to the United States of America. When most people are back at their trading desks after Labor Day, these are just a few of the things that have to be taken into account by the lab rats:

* More fights over the Federal budget, more regional bankruptcies, and a debt-ceiling scrap…one or more of which could severely damage Washington’s ability to function.

* Bernanke lighting the gunpowder fuse with his taper tapering off the QE that has kept the Karno Sky Circus up there with the spinning plates….followed in short order by the hospital pass to his successor.

* The German elections

* The Spanish, Italian and French crises waiting to happen

* The likely beginning of euro bailins following bank failures….most notably, the Deutsche Bank problem.

* A hotting up of the Cold War between Frankfurt’s Bundesbank community, and the loopy-loos in the Chancellery.

* What Abe-san does next in Fortress Japan.

The two biggies here, in my view, are the German elections and Japan. If Merkel is re-elected – now that France has near-zero exposure to Greek debt – the anti-contagion school will once more be in the ascendancy. I don’t buy this myself, but there is definitely some feeling across the EU that Greece just might be unceremoniously dumped in the New Year; this would also improve Merkel’s relationship with her central bank.

The Japanese outlook is equally open to the unpredictable. The financial markets loved it when mad person Shinzo Abe announced his strategy last year: share prices boomed, the yen fell, and growth surged after the new government began a massive bout of quantitative easing. The Slog at the time was less than complimentary about the idea….and concerned that this appeared to be Dark Carney’s ‘big idea’ for us. The inevitable is now coming to pass: the GDP data are well below what was expected, and surprise surprise, the cost of imports is rising. This is not a small problem: even though the yield on 10-year Japanese Government Bonds (JGB) is 1%, the interest on that will exceed 22.3 trillion yen in the fiscal year that began in July. This is one-quarter of the general account budget. If the bond yield rises to, say, 2%, the interest expense would surpass the total expected tax revenue of 42.3 trillion yen.

Secondly, I turn to a metal whose low profile over the last few weeks – and tell-tale signs of ‘bullishness’ – give me odd feelings in the bladder contents. Gold has for the last few working days been creeping up again – from $1330-1360 – for which there is no fundamentals rationale whatsoever…given talk of the eurozone ’emerging from recession’ and both the UK and US fixing their data feeds to suggest ‘recovery’.

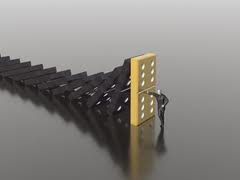

I smell a rat here. Note that – as I posted yesterday – the EU Bailin Law seems likely to exclude derivatives. Draghi’s obvious role in that decision makes it clear that the major players know perfectly well how big the derivatives Tsunami will be if and when it makes landfall. And as under Basel III the Canutes have rigged gold’s value upwards in bank balance sheets, stuffing every central and big regional bank full of it remains the priority. People are being suckered in again: some time in the next eight working days, I think gold will take another dive….this time – who knows? – back into three figures.

But back on Planet Britannia, Fillip Baldrick says Greece is almost through the tape. In keeping with this dearth of sensory equipment, the Bank of England seems to have mislaid 1300 tonnes of gold. To be more accurate, 100,000 gold bars have been moved/leased out to somewhere – a term in this context that continues to baffle me (did some Russian billionaire want it as a wedding centre-piece?) but there you are. Anyway, veteran gold investment manager and guru Alasdair Macleod reckons…..guess what? “The Bank has been flooding the market to suppress the price,” he opines, “and 1300 tonnes is more than enough to do that”. Either that, or Merv the Swerve stuck a few ingots in his pockets as he wound down to retirement.

This ‘flooding’ represents pretty much what Fort Knox and the Fed’s deep reserves were used for between roughly 2006 and 2010…most of it having been snapped up by China, with the rest by India.

Like I say, the portents aren’t good: KTF well away from gold, if you’ve got any sense.