If like me you have thought from time to time since 2008 that the world economic system is based on privatised nationalisation, State controlled personal liberty, debt-reduction through zirp credit, and monopolist free market protectionist global mercantilism, then let me set your minds at rest. It’s a lot easier to understand than it sounds.

I am finally at liberty to divulge here today what economic system the World is using. It’s uses an all-round 360-degree view of that world, and is thus 120 times more effective than systems employing only The Three Degrees format below.

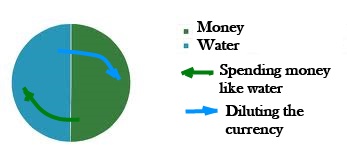

Sorry, that was an entirely gratuitous shot. It was also a cheap shot. I shall try to be more serious. The 360 degree system itself is not so much a cheap shot, as an expensive shot in the dark. In a nutshell, the circle has one name, but lots of different directions. Think of it as a proactive compass: it blows with the wind, and deals with it by taking a piss in the ocean.This is because it is the first economic approach to have recognised the infallible relationship between money and water. The globe is thus envisaged like this:

Sorry, that was an entirely gratuitous shot. It was also a cheap shot. I shall try to be more serious. The 360 degree system itself is not so much a cheap shot, as an expensive shot in the dark. In a nutshell, the circle has one name, but lots of different directions. Think of it as a proactive compass: it blows with the wind, and deals with it by taking a piss in the ocean.This is because it is the first economic approach to have recognised the infallible relationship between money and water. The globe is thus envisaged like this:

Because of its incredible ability to conjure up wealth, perform many different illusions, and look like a globe, it’s called the Global Magic Circle (GMC) School of economics.

I think the GMC school was best summed up by occasional Slog columnist Professor Fuller Bollix, who described it thus:

“The GMC system works on the principle of having no principles. It uses whatever levers are there to pull when something goes wrong, until things begin to look right. Sometimes this means stealing ideas from other economic theorists, and sometimes it means stealing your money. When things are going right it’s called neoliberalism,and when things are going wrong it’s called State socialism of which Milton Friedman would never have approved. It is essentially a system employing a judicious mixture of traditional ideas over and over, and then using the future tense of the verb ‘to taper’.”

As Professor Bollix points out above, the system now evolving is essentially one of broader choice and no alternative, lower taxes alongside more borrowing, dominoes falling on a Monopoly board, no role for the State in economics but an enhanced role for the taxpayer in bank rescues, absolutely no protectionism in trade alongside leveraging national currencies, mercantile globalism alongside regional imbalances, and of course the healthy duopoly of one law for the filthy rich, and another for the dirt poor. Laymen sometimes call this Making it up as you go along.

For example, Americans pay very low petrol taxes and some of the lowest top tax rates on the planet, but borrow 90% of their money from a country where 90% of citizens live at or below the poverty line. At the same time, the Top 5 Custodial Firms on Wall Street have $65 trillion under management, which is half the World’s Wealth. When the US banking system nearly failed in 2008, the State couldn’t interfere so the taxpayer forked out $750 billion to save things which had become too big to fail, because they controlled 65 trillion bucks.

This is a classic example of GMC working at its best by using impenetrable contradiction theory in practice.

In the UK other examples abound. The Chancellor there Mr Osborne has cut £17.5bn off the relief money available to those who have least, while his central bank has given £450bn to the banks it can’t control in order to keep the system liquid and so under control. When the system doesn’t become any more liquid and goes out of control, the concept of bailout is reversed to one of bailin, but as the effect is exactly the same, there are no changes for the taxpayer to worry about. Each taxpayer simply changes from being a taxpaying customer to being an exposed creditor.

In the European Union (EU) things work differently, but the basic tenets of GMC are exactly the same. The accepted method for helping countries whose leaders have overspent is to slim down the economy that provides work for those further down the food chain. This ensures a lowered cost of output (‘desperation’) and thus more competitive exports in much lower volumes. Although the idea is still in its infancy, there are encouraging signs that the approach will always work next year. Similarly, the European Central Bank (ECB) has adopted a radical strategy for reducing dependence on unsafe banks, by subordinating foreign investors. The resultant capital flight leaves the banking system leaner than it was, and encourages entrepreneurial independence in the population (‘tax evasion’).

The best way to think about GMC economics is, in my view, as a moving target….like a sort of ethereal, smoky substance that defies gravity, mirrors, and any attempt at lassoing it. This gives GMC the freedom it needs to work at optimal efficiency – a situation we are all witnessing now – without Communist wreckers ever shooting it down.

I think that explains everything. I’m off for a swim.

Yesterday at The Slog: How a tripartite conspiracy has Paul Gambaccini it its clutches