The disconnect is now too massive to hold: get TF out of equities

The disconnect is now too massive to hold: get TF out of equities

Failing QE, withdrawn QE and dithering QE can’t support stock markets for much longer. The reality cheques are all too clearly unsigned. Anyone staying exposed to stocks from here on is risking everything they’ve got. And even the mainstream market movers are now saying the same thing.

Elliott Associates, founded and run by Paul Singer, is noted for its relatively high returns and low volatility. The New York Times called Singer ‘one of the most revered’ hedge fund managers on Wall Street. Elliott returns have generally outpaced the annual growth of the S&P 500. From inception, Elliott has generated for its investors a 14.6% net compound annual return, compared to 10.9% for the S&P 500 stock index,[7] while having only one-third of the index’s volatility.[8] The firm is currently closed to new investors.

So in short, Elliott have nothing to sell, no axe to grin, no bollocks to spin. This is what its legendary CEO said in the last 48 hours:

“Nobody can predict how long governments can get away with fake growth, fake money, fake jobs, fake financial stability, fake inflation numbers and fake income growth…..optimism about U.S. growth is misguided, economic data understate inflation and overstate growth, and central bank policies of the past six years aren’t sustainable…We do not think this optimism is warranted, and we think a lot of the data is cooked or misleading. A good deal of the economic and jobs growth since the crisis has been fake growth, with very little chance of being self-reinforcing and sustainable…the unemployment rate at 5.9% in September doesn’t reflect that the workforce participation rate is at a 35-year low, and full-time jobs have been replaced by part-time jobs, and high-paying jobs by relatively low-paying jobs. Real wages have been stagnant since the financial crisis….there have been no “significant structural improvements” since the financial crisis that would allow the developed economies to grow faster. Our belief is that the global economy and financial system are in a kind of artificial stupor in which nobody (including ourselves) has a good picture of what the next environment will look like.”

I’ve been trying where possible over the last four months to point up when a confluence of data shows that the fantasy cannot continue indefinitely. We have started this week in another coming together of flood-swollen streams of information.

From Zero Hedge comes the observation that ‘global commodity prices (that would be the ‘stuff’ that is used to make the ‘stuff’ we all buy every day) are collapsing at the fastest rate since Lehman…’.

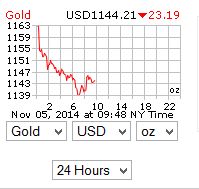

And yet at the same time, today’s continuation of the gold price destruction shows another $20 fall so far since yesterday’s close.

And yet at the same time, today’s continuation of the gold price destruction shows another $20 fall so far since yesterday’s close.

In just a fortnight, an oz of gold has fallen $200 in value.

Yet it is doing so in a time of unprecedented economic uncertainty, where (see above) ‘ global commodity prices (eg, oil) are collapsing at the fastest rate since Lehman…’.

In the eurozone, there are inexplicable delays in enacting Draghi’s intention to buy assets aka toxic waste along the same lines of the US, UK, China and Japan….all of which ended in failure. The delays are accompanied by rumours of chaos within the ECB, threats of resignation, and screaming telephonic rows between Frankfurt, Brussels and Berlin.

The oil-price plunge at the same time – a first? – means that shale drillers will rapidly be in trouble rationalising any business model, and the obvious overdependence of Russia on oil exports (predicted endlessly here over the last 18 months) has resulted in – at last – the Russian Central Bank giving up on purchases and simply letting the Ruble plummet.

There is no easy way out of this situation. The only way to minimise damage, in my view, is to get out of stock markets completely. But I’m not a certified advisor: this is merely what I’m doing, as of an hour ago. What you do is your own affair.