Who really has the Midas Touch?

The new Gold Rush: I wonder if there might be a much bigger game in play

As gold yo-yoes up and down from $1292-1300 on the markets, it’s now official: the shiny stuff is on its longest rally for nearly a year. In a level-playing-field kind of world, one would look at the global slump, ClubMed teetering on the brink and Supermario desperation, concluding, “Flight for safety – this is the breakout…pile in!”

Two days ago, the IMF – that Masterclass in forecasting – cut its Global Growth forecast yet again. Another safe-haven signal. Four days before that, the Swissy uncoupled itself from the euro: I don’t think anyone, as yet, is certain why they did that…but it looks increasingly like the order was given by the man at the Big Franfurter with MD as his initials.

As we’ve known since 2006, when it comes to gold, the playing field is really one of those amusement arcade footie tables that one can tilt with a toe-pedal. It’s a game: it’s not real, and anything could happen. Fundamentals no longer count, because the arcade owner is bankrupt, so he needs everyone to lose. And trust me, we are targeted to be the losers: sometimes, the past is a perfect guide to the future.

Think on this: last November and December, the big news in gold was that record volumes were being mined. That still left the new stocks 20% down on the year…but why did the miners suddenly up their game? What (or who) gave them their confidence….given that bullion was doing OK for much of the period – but not exactly setting the world alight? In 2013, gold prices slumped by 28%, and in 2014 the fall was 1.5%. Not exactly A Rush. “Gold value is being deliberately destroyed by the banks,” people said – and I was one of them.

So why the miner bullishness about the metal?

A week before Christmas, distinguished dealer and gold guru Andrew Schechtman had this to say about who was buying bullion, and why:

“We used to get 200 phone calls a day and now we only get 30 to 50, but we’re doing equal or greater volumes. The order sizes now are much greater. Today’s precious metals investors are more sophisticated…The big money is afraid. There’s such a counterintuitive feel to what’s happening…the sophisticated investor understands that precious metals have real value.”

Ah-haa, one thinks: the smart money’s piling in early…let’s get in before it’s too late. But hold hard: it’s not that simple. Nothing is simple any more. For example, what did Schechtman mean by “big money”? And since then, the US Fed has been leaking a little here and there that hey, we might just not raise rates this year after all – so that makes Gold more of a buy. But Fed speak forked tongue, allegedly. And some of this latest spurt to a $1300 floor is saps following prices in a classic bandwagon effect.

Take a look at gold futures: last night US EST, Bloomberg noted that ‘Gold futures approached $1,300 an ounce to post the longest rally in 11 months as signs of slowing global economies boosted demand for the metal as a haven.’ But the overnight markets already turned the future into the present: again, not necessarily sensible buying….especially when you consider that call options (giving option owners the right to buy February futures at $1,300) have soared 10-fold since Christmas.

Having said the fundamentals are scarcely a consideration any more, remember that on two key dimensions, a rising gold price at the moment is counter-intuitive: we have a strengthening Dollar, and we have almost the entire world heading for deflation – if not in it already. But spookily, that brings us right back to the Dance of Prickness, Dario Marji.

There are a few folks on the fringes of the Machiavellian Machinations of the Mad Masters who continue to wonder exactly who Dario is “working for”. Some of them live in Frankfurt, one in Berlin, and one in New York. OK, the margin of error on a sample size that small is ginormous, but let’s not digress: they, like me, watch a highly intelligent bloke embarking on a massive QE punch that every shred of evidence available suggests (a) won’t work in an economic sense and (b) could very easily destroy the euro’s credibility – especially when mingled with Grexit (which now looks to me very likely) Italian default, and Spanish collapse.

I suspect some of that ‘big money’ I mentioned earlier sees this coming, and thus sees gold as a no-brainer. But you might take a different decision if you think, in relation to euro-destruction, “Maybe that’s the idea”. And to complicate things further, I merely toss this in for your attention: albeit surreptitiously – and despite a huge crisis in Moscow plus a slowdown in Beijing – Russian and Chinese gold buying has shifted two gears in the last eight weeks. I suggest that, if you were putting a gold-backed Rublenimbi anti-Dollar together, that is pretty much what you’d do.

What I would also like to raise, however, is an additional observation: if you were trying to save the euro, I submit, you wouldn’t be doing what Dario is doing now.

The bigger game: Petrodollar v Antidollar

It’s possible – no more than that, but possible nevertheless – that the bigger game in play here is Western central banks and Dollar hegemony on the one hand, versus the Alternative Anti-Dollar Rublenimbi on the other. And that Mr Marji is batting for the Dollar and CBs team – not the Brussels euro-team.

I feel a twinge in my water, and it suggests that Draghi’s QE bazooka is a weapon in a bigger war…and it’s not facing the way most people think. Pushing the Greeks out while watching Italy implode and the euro’s death-throes is going to be another big buy-sign for gold. By the summer of 2015, the gold price could be sky-rocketing….until one day, suddenly, something else “unexpected” happens….and the price collapses to the final revaluation level – at which point, it gets hoovered up by the faux bears.

This isn’t conspiracy theory stuff, it’s informed speculation with a point to it. I have no idea what to do about gold at this point, and I’m not a qualified adviser. I would merely point out three things:

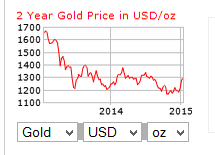

1. If you’re going to get into gold as a short-term gain, think carefully. Look again at the Two-Year chart:

On this timescale, the current bullish run appears as nothing more than a third rally, as gold heads down to the crushed price at which The Goldfingers would like to buy it. On such an investment tactic, this is a short-hold watch it 24/7 punt.

On this timescale, the current bullish run appears as nothing more than a third rally, as gold heads down to the crushed price at which The Goldfingers would like to buy it. On such an investment tactic, this is a short-hold watch it 24/7 punt.

2. For gold as a long-term hold, you’re going to need a calm sphincter and a slow heart-rate. You may, I think, watch your investment being halved quite soon. But at the other end of the post-sell rainbow, you may see it multiply many times more. The point is, you have to have and to hold: you have to be the last bull standing. Above all, sadly, I think you have to be rich.

3. There is every chance that the addition of the Rublenimbi element could destroy all these scenarios and more. Just because – as I suspect – two currencies are emerging with what may be seen as credible backing in the shape of gold, you have to understand – that isn’t the Washington/Wall Street aim: their game plan is Thou Shalt have no other Dollar but Mine….the PetroDollar that lives on into infinity. Otherwise, there is no point to any of it.

So the bottom line again is, you could caught in the crossfire of a fight to the death.

I’m not rich and I might have a punt. I genuinely don’t know. But these are exciting times.

I do promise this is not special pleading: clearly, a series of somebodies do not want this post to be given the oxygen of publicity. I would therefore ask that, in the interests of free speech, you help me do that. Thank you in anticipation.