Other factors are about to come to the fore in China, and the West has more to face beyond a Chinese implosion

As the PBOC printed a few billion more yuan overnight, things on the Shanghai Composite have gone from temporary fingers in the leak to mutliply-installed automatic pumps:

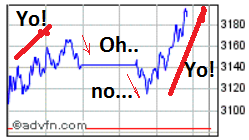

For those of you unfamiliar with the Wu Chinese language group native to Shanghai, the phrase yo oh no yo looks like this

For those of you unfamiliar with the Wu Chinese language group native to Shanghai, the phrase yo oh no yo looks like this

and is pronounced shi-o-fou-shi. This is simplified Chinese, more literally translated as “Why am I pushing this stupid index up, aaargh a doubt has entered my inscrutable mind – quick!….more Yuan!….oooooh, that’s better”.

and is pronounced shi-o-fou-shi. This is simplified Chinese, more literally translated as “Why am I pushing this stupid index up, aaargh a doubt has entered my inscrutable mind – quick!….more Yuan!….oooooh, that’s better”.Slowly, however – at the very core of the West’s bubble itself – reality is intervening among the pros about a lot more than Chinese meltdown: dollars are still leaving the stock markets in search of better returns and lower costs, and importantly the ‘price-insensitive sale’ trade is firmly established in New York: this is peopled by folks who must sell equities – be they good trades or bad, these are not margin calls any more, they’re credit calls.

We’re seeing this reflected in today’s futures numbers: contracts on the S&P 500 expiring in September lost 0.8% in New York, as did those related to the Dow Jones Industrial Average. And lest we forget, ‘rally’ or not, when the S&P 500 closed yesterday, it was still down 5.5% for the month.The Nikkei is 1500 points below where it was on August 10th, and the Australian ASX 200 fully 9% lower than it was on August 3rd.

Late afternoon CET today (Friday), the Dax is down 0.7% and the FTSE has clawed itself back to no change on the day: across the Pond, the Dow, S&P, Nasdaq and NYSE composite are seismographing up and down to little effect. Nothing dramatic, but this is beginning to feel like a rally-car with one of its wheels loose.

Enjoy the weekend.

Earlier at The Slog: Britain’s Silent Property Debt Disaster