The Ruble is a lead balloon signalling a Russian crisis to come

Just under a month ago, The Slog posted about the unfathomable depths of Russia’s true toxicity…and the level to which RBS is still, I understand, over-exposed to it. Then only five days ago I asked if ratings agencies know which way is up in Russia….because I suspect they don’t.

Since then, the writing on the Wall of Global Depression has grown both larger and more Dayglo in its colouring

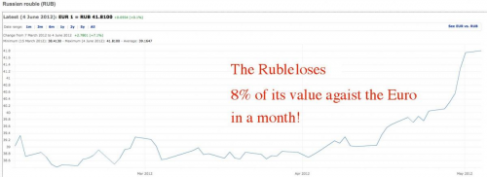

There are very few currencies doing badly against the euro at the minute, but one is the Ruble:

Hat-tip to analyst-blogger Bruce Kasting for the above; and, as he rightly says, during April the Russian currency lost out substantially to a euro in crisis. (The following month, it lost 14% against the Dollar.) Bruce also spoke with a Swiss banker who told him that, despite the massive flight to Switzerland for money saftey in recent weeks, the biggest inflow came from Russia. The Gnome told him the reason: “It’s politics and economics together. People are afraid” he said – and that’s my view too: Putin’s power base is nowhere near as stable as many in the West think, and in a depression – when people don’t want to buy much energy – Russia has to be one place that will catch a serious case of pneumonia.

The ‘experts’ are as usual wrong. In January this year, they agreed that in 2012 the Russian economy ‘will follow basic world trends. Continuing mild recession, with no big economic shocks is the forecast.’ Well, got that one badly wrong fellas – and so the obverse now applies.

As late as the end of March this year, the World Bank was still spouting twaddle about Russia: (my emphasis)

‘“In 2012, the current account looks strong as a result of a large surplus in the trade balance,” said Michal Rutkowski, World Bank Country Director for the Russian Federation. “Although, the net capital outflows increased considerably in 2011, the main reasons seem to lie outside Russia and relate to uncertainty about the global recovery and concerns over the euro zone that led to a flight to safety...’

I think that’s deluded too, frankly: intelligent Russians know which way the wind is blowing politically and economically: they rightly foresee unstable government and massive falls in energy demand. Almost all of Russia’s recent economic growth is in value – based on high global oil prices. Beyond that lucky bounce, Russia’s further economic growth remains subdued, in spite of high oil prices. Indeed, Russia’s recovery from the 2008 crisis was laggard compared to many other economies of the world.

Russia is in a similar position to Australia: it exports very little in the way of added-value manufacture, and is hugely overdependent on global economic growth needing raw materials and energy. My information is that foreign investors, senior businessmen and well-placed people in the regime are gloomy. I think the oil price decline will continue, and so Moscow will be forced into a huge budget deficit: caused by lower tax intake from slowed economic growth…plus a whole shedload of money required to defend the Ruble’s credibility.

Not many ‘experts’ talk about the EU’s banking exposure to Russian debt, probably because they don’t grasp just how corrupt and unreliable most of the borrowers are. My hunch is that they’re about to find out.