Will the consequences of an oil-glut be golden?

Will the consequences of an oil-glut be golden?

Consequences. If I had to choose one word that sums up the neoliberal globalist Weltanschauung, it would be ‘consequences’. For those yelling for Friedman with all their might (while telling us we should learn to love the banks) take one of two attitudes to consequences: either they don’t GAF about them, or they’re too thick/up themselves to see them coming.

The current oil price is, in part, a consequence of fracking. Clowns like Dan Hannan, David Cameron and their “Let’s get fracking!” mantra are at last being shown up for the strategic featherweights they are.

To be more precise, pressing ahead with fracking at precisely the wrong moment was a major cause of the plummeting price of crude. Too many superficial observers blathering on about ‘the global recovery’ allowed the fantasists to believe that it really was happening….especially if you call QE an ‘economic activity’. But as The Slog and a thousand other sites have been saying since late 2010, take QE out, and the world is in the deepest recession since capitalism rose to dominance.

It is now heading towards slump at an alarming rate. This would’ve depressed the price of oil anyway, but those wishing to dig up what’s left of Britain (and underneath our houses) were quite happy to threaten our frail water supply on the flimsiest of tightly-spun evidence. And so here we are with energy bonds going up the pictures: big boom in North Dakota, deep doo-doo everywhere else. Consequences, everyone: there are always consequences.

Someone should’ve pointed this out in turn to the energy-obsessed government in Washington and its geopolitical meddlers, who thought it would be just dandy to conspire with OPEC to keep the gushers going and thus bring Russia to its knees. Obama tried to back-pedal when some real people finally told him that panic had broken out…but by then, it was too late: OPEC chose at first to keep everything the same, and now finds itself unable to agree on how to pull back. The organisation seem on the verge of extinction….and whatever they do, natural market effects are kicking in bigtime.

Yesterday’s global output data was, not to beat about the bush, diabolical. And the reasons are the same as those hammered at here for the last three years: you cannot keep mercantile globalism going (let alone growing) if the number of people able to pay for your goods is falling, your prices are too high, and your deficit is too big. The outdated US output, the unbalanced UK output, the expensive western eurozone output, the China dependent Australian output, the energy-dependent Russian output…they all collapse because China is slowing down, and China is slowing down because the indebted economies won’t consume their goods any more: the chicken is chasing the egg which is chasing the chicken which is….

No amount of insane Bank of Japan QE is going to change that. And that too will have its consequences before too long. I still think there’s a good chance that an extremely cold European winter could yet stop the oil-dump for Putin; but even his smart use of gold to get reserves up can’t go on forever with a rouble heading for the sewage system by the hour.

It’s all turning into an almighty mess which – if we’re honest – might never had happened on this scale if the Washington-prodded Sprouts in Brussels hadn’t stuck their unwelcome noses into Ukraine. But the world slump and fracking were both screaming for an oil collapse even without the Bear-baiting oil manipulation of Autumn.

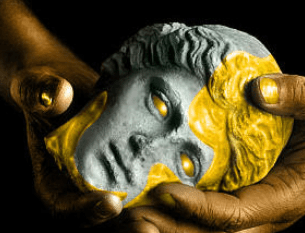

Of course, the consequences will continue to spread…because the acceleration of a multidimensional energy crisis may yet sabotage the central banks’ determination to crush gold’s value down to around $700…before sweeping it all up and then revaluing it within their assets. More smartarses ignoring the consequences for everyone else, and more idiots in Bankfurt squabbling over eurozone liquidity don’t help.

Up until now I’ve felt confident that gold would continue quietly dropping down to the CBs’ required purchase price during next year. But I fancy the virtual implosion of OPEC’s influence over the last 48 hours is a game-changer that requires one to at the very least hedge some bets.

Not only will the OPEC vacuum create huge problems for the Venezuelas of this world: it must also increase the artificially dulled awareness of just how truly global the ‘All Stop’ is going to be. That plus the continued tapering of QE points to a major stock market correction looming ever loser. And that will probably mean a rethink about the right buy-signal for gold.

It behoves me (and all of us with open minds) to see if a gold rally can change the shape of the 90-day chart. If it starts to do that, then momentum might shift things exponentially. And if it does, then a lot more bankers are going to be jumping out of windows.

The powers that aspire to be unassailable are showing signs of having lost control at the moment. The Shanghai Composite Index dropped a calamitous 5.4% last night. China is rumoured to be reconfiguring its growth back to 7% in 2015. The increased likelihood of snap Greek elections has thus far wiped nearly 13% off the Athens bourse. The S&P and Dow indices retreated 1.5% yesterday. That might not sound like much, but it is a seventh of this year’s entire growth wiped off…in one day.

Much depends on what Janet Yellen decides to do next. But the Fed still seems to be on Cloud Cuckoo. Yesterday’s FOMC statement talked about “enouraging headline jobs numbers” and “less tapering nerves as the economy improves”. I would have to see that as a piece of pure Warren Harding.

Thoughtless greed begets consequences, which in turn beget consequences, and eventually beget unforeseen consequences. Plus ca change, as we say in these parts.

Related at The Slog: The collapsing economies of the Eunatics