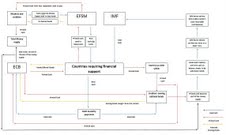

Mario Draghi’s debt monetisation: it’s already under way…and here’s how he does it:

For those of you without opera glasses to hand, you can view this schematic diagram in larger format at

http://postimage.org/image/6j1ixhxm7/

It represents how the ECB can monetise the debt of ‘at risk’ countries using printed capital, whilst allowing the ECB to control inflation and the size of the money supply. In short, it appears to allow the eurozone to pay its debts with printed money and then remove it from the system at a later date – in other words the eurozone can pay its bills…then burn the money it used to pay them with.

The system in principle at least allows for the payment of interest on ‘at risk’ nation debt ( therefore controlling yield rates) and allows for the repayment of the principle capital on existing bonds. All with a ratio of printed money v. real money that would be classed as fraud if it was attempted by any organisation other than the ECB. The clever thing is that the more bonds the ECB buys, the better the ratio…..and the easier the matrix is to maintain.

The viability of the ECBs balance sheet is a nonsense, as under this system it can guarantee repayment of both yields and principles on all the bonds it buys so it doesn’t have to classify them as liabilities. And once it’s been repaid with its own printed money it can remove it from the system.

It can effectively recapitalise the banks, recapitalise ‘at risk’ nations, and ensure that currently stable nations stay that way….all the while ensuring that cuts the Germans want are made with little risk other than to the population.

And as we know already, the population doesn’t count in their calculations.

Many thanks to Doctor A for the full explanation.

Earlier at The Slog: Arrests and suicide in Greece – the aftermath of Lagarde’s List of tax dodgers