Have you noticed that every day now is ‘World Something Day’? Of course you have…it’s impossible to miss. World Squirrel-tickling Day, World Gravel Day, World Skin Cleanser Day…the list goes on and on.

So I have declared April 4th henceforth to be World Reality Day…

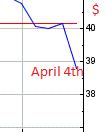

They took their time, but the markets finally decided that the oil rally isn’t actually based on anything beyond false witness and some blatant directionalisation….and a whole lot of other stuff less obvious too, I’d imagine. So now crude as a sector is heading down again. Last Friday, the talk was “likely average price for 2016 around forty bucks”. So far today, (midday CET) the walk is “around $36 average for 2016”. This was the noon futures chart for today:

The drop that preceded Friday’s hammering of nails into the oil coffin was smart money getting out. The outlook for other commodities central to economic activity is equally lacklustre – and the most important measure – for me, copper futures – is down for May and further down for June. All the key lumber futures are levelling prior to what I’d guess is a downturn; for a trader, betting against the May contract level would make sense….and almost certainly, money.

But these are all details….the overall picture remains the same: as they say on Boombust TV, “the disconnect is to the downside”. Decoded, that means Correction4 cannot be far away. You read it here first on March 30th, and once again the signs are building. Last week’s US payroll data sounded good – 200,000 jobs added – but there are always three massive caveats here:

- Jobs in the West as a whole are increasingly about quality, not quantity: 200K jobs paying $240,000 per annum on a 3-month contract being replaced by 200K zero-hours jobs paying at best $12,000 a year is not a healthy sign. The inevitable outcome is deflationary.

- The US labour force participation rate (lfpr) went up 0.1% over the same period. Taking the seasonally adjusted figure for the total size of the force, that adds up to 160,000 jobs. This somehow suggests that 40,000 of the jobs were very temporary, because otherwise over the period the lfpr would’ve been higher: that is, at least 20% of the jobs were short-term casual.

- The lfpr – for any self-respecting statistician – has long lacked any real credibility. This is not a politically partisan statement: Slick Willy Clinton started the ridiculous practice of using drops in welfare request data as evidence that people had found permanent employment. As permanent employment barely exists any more – and permanent welfare doesn’t exist at all – that whole practice is daft; but it didn’t stop both Bush and Uncle Tombama from adopting it too.

The overall result of these combined but unrelated figures is to create something impossible to read…and for politicians, this is I’m sure the major attraction of it. Until such time as we have some sort of job gains/loss analysis based on value not volume, this situation will continue. In the meantime, several highly-rated US commentators rightly maintained over the weekend that the ‘jobs creation’ being recorded simply doesn’t tally with the growth data. Janet Yellen is acutely aware of this, I’m told: I suppose one must see this as some kind of relief. Sadly, it has not as yet permeated the skulls of Britain’s Black Knights of Camerlot.

Reality raises blood pressure. It is therefore only a matter of time before the Health & Safety Executive bans it.